DEF 14A: Definitive proxy statements

Published on May 2, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement | ||||

☐ |

Confidential, for Use of Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

☒ |

Definitive Proxy Statement | ||||

☐ |

Definitive Additional Materials | ||||

☐ |

Soliciting Material Pursuant to §240.14a-12 | ||||

PERIMETER SOLUTIONS, SA

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

No fee required | |||||||||||||

☐ |

Fee paid previously with preliminary materials | |||||||||||||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||||||||

May 2, 2022

Dear Fellow Shareholder:

On behalf of your Board of Directors of Perimeter Solutions, SA, you are cordially invited to attend the 2022 Annual Meeting of Shareholders (the “Annual Meeting”), which will be held online via a live webcast, at 8:00 a.m. (CDT), on July 21, 2022. The Annual Meeting will be held in virtual format to protect the health of our shareholders, directors and guests during the continuing COVID-19 pandemic and to make the Annual Meeting accessible to all of our shareholders. To participate in the Annual Meeting, you must pre-register at www.proxydocs.com/PRM by 5:00 p.m. (CDT), on July 20, 2022. Upon completing your pre-registration, you will receive further instructions via email, including your unique link that will allow you access to the Annual Meeting and will also permit you to submit questions prior to the Annual Meeting.

The attached Notice of 2022 Annual Meeting of Shareholders and Proxy Statement describes the business to be conducted at the Annual Meeting. Also included are a proxy card and postage-paid return envelope.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, please vote and submit your proxy: (a) by telephone or the internet following the instructions on the enclosed proxy card or (b) by signing, dating and returning the proxy card in the postage-paid envelope provided.

If you attend the meeting and desire to vote virtually, you may do so even though you have previously submitted a proxy by following the instructions included in the attached Proxy Statement.

Your vote is extremely important.

We hope you will be able to join us, and we look forward to seeing you at the meeting.

Sincerely yours,

| W. Nicholas Howley | William N. Thorndike Jr. | ||||

| Co-Chairman of the Board of Directors | Co-Chairman of the Board of Directors | ||||

NOTICE OF 2022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JULY 21, 2022.

TO BE HELD JULY 21, 2022.

To the Shareholders of Perimeter Solutions, SA:

The 2022 Annual Meeting of Shareholders (the “Annual Meeting”) of Perimeter Solutions, SA, a public limited liability company duly incorporated and validly existing under the laws of the Grand Duchy of Luxembourg, having its registered office at 12E, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg and registered with the Registre de Commerce et des Sociétés, Luxembourg (Luxembourg Trade and Companies Register) under number B 256.548 (the “Company”) will be held online via live webcast, at 8:00 a.m. (CDT), on July 21, 2022. The Annual Meeting will be held in virtual format to protect the health of our shareholders, directors and guests during the continuing COVID-19 pandemic and to make the Annual Meeting accessible to all of our shareholders. To participate in the Annual Meeting, you must pre-register at www.proxydocs.com/PRM by 5:00 p.m. (CDT), on July 20, 2022. Upon completing your pre-registration, you will receive further instructions via email, including your unique link that will allow you access to the Annual Meeting and will also permit you to submit questions prior to the Annual Meeting.

As part of the Annual Meeting, we will hold a live question and answer session, during which we intend to answer questions that are submitted in writing during the meeting by our shareholders and are pertinent to the Company and the business of the meeting, as time permits.

Attendance at the Annual Meeting will be limited to shareholders, those holding proxies from shareholders and representatives of the Company. You will not be able to attend the Annual Meeting in person at a physical location. For more information about how to attend the Annual Meeting online, please see “Questions and Answers About the Annual Meeting and Voting” in this proxy statement.

The purposes of this meeting are:

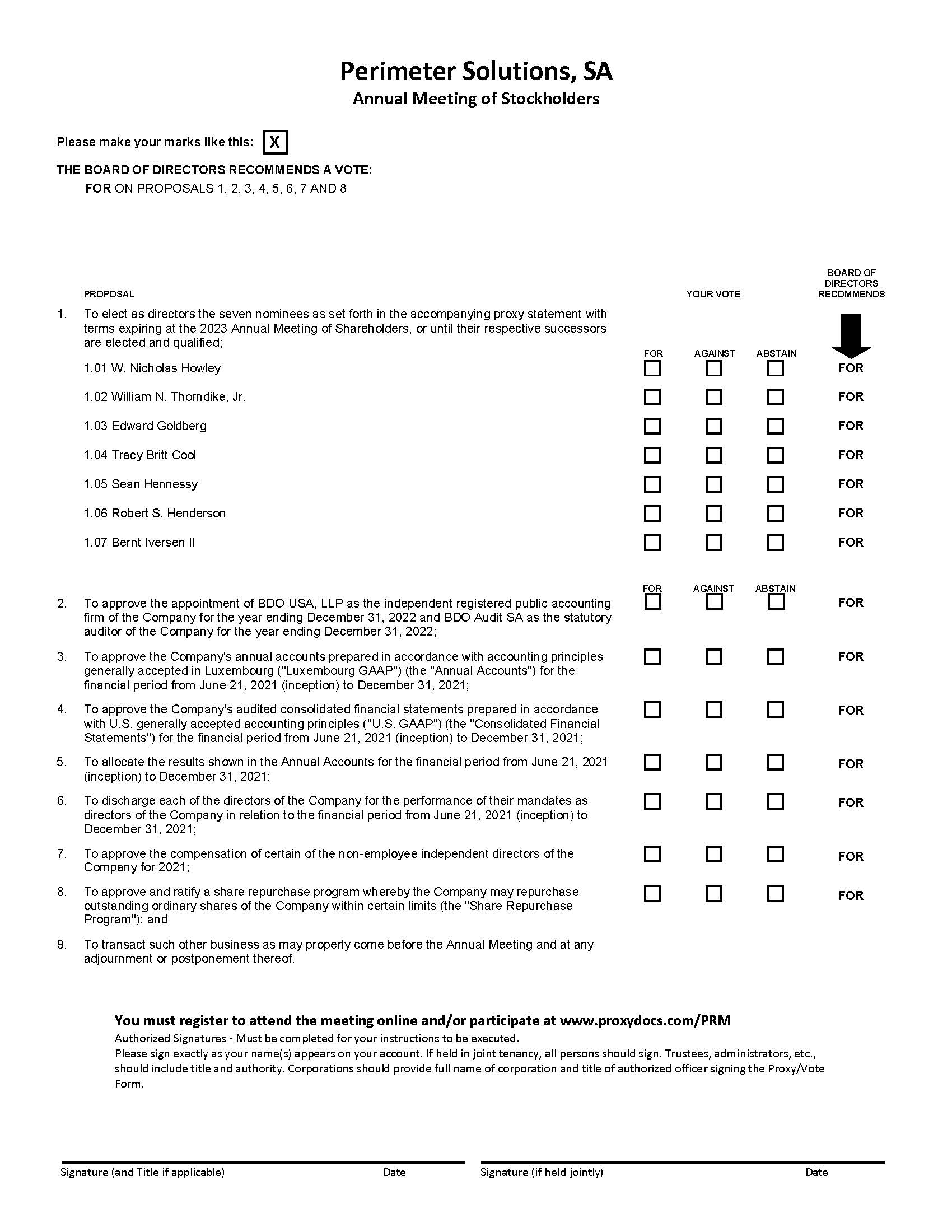

1.To elect as directors the seven nominees as set forth in the accompanying proxy statement with terms expiring at the 2023 Annual Meeting of Shareholders, or until their respective successors are elected and qualified;

2.To approve the appointment of BDO USA, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2022 and BDO Audit SA as the statutory auditor of the Company for the year ending December 31, 2022;

3.To approve the Company’s annual accounts (the "Annual Accounts") prepared in accordance with accounting principles generally accepted in Luxembourg (“Luxembourg GAAP”) for the financial period from June 21, 2021 (inception) to December 31, 2021;

4.To approve the Company’s audited consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) (the “Consolidated Financial Statements”) for the financial period from June 21, 2021 (inception) to December 31, 2021;

5.To allocate the results shown in the Annual Accounts for the financial period from June 21, 2021 (inception) to December 31, 2021;

6.To discharge each of the directors of the Company for the performance of their mandates as directors of the Company in relation to the financial period from June 21, 2021 (inception) to December 31, 2021;

7.To approve the compensation of certain of the non-employee independent directors of the Company for 2021;

8.To approve and ratify a share repurchase program whereby the Company may repurchase outstanding ordinary shares of the Company within certain limits (the “Share Repurchase Program”); and

9.To transact such other business as may properly come before the Annual Meeting and at any adjournment or postponement thereof.

We mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2021 on or about May 2, 2022.

We will make available a list of shareholders of record as of April 14, 2022, the record date for the Annual Meeting, for inspection by shareholders during normal business hours from April 14, 2022 until the day before the Annual Meeting date at (i) the registered office of the Company at 12E, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg and (ii) Company’s offices at 8000 Maryland Ave. Suite 350, Clayton, Missouri 63105. The list also will be available to shareholders virtually during the Annual Meeting.

Only shareholders of record as of the close of business on April 14, 2022 are entitled to notice of and to vote at the Annual Meeting. Our Board of Directors recommends a vote “FOR” each of the director nominees in proposal 1 and “FOR” proposals 2 through 8.

It is important that your shares be represented at the Annual Meeting. Whether or not you expect to attend the meeting, please vote and submit your proxy over the internet, by telephone or by mail. Please refer to the proxy card for specific voting instructions.

|

By Order of the Board of Directors,

|

|||||

|

May 2, 2022

|

Noriko Yokozuka

General Counsel and Secretary

|

||||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2022 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 21, 2022.

The Company’s Proxy Statement for the 2022 Annual Meeting of Shareholders and the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 are available free of charge, upon written request. Requests should be made in writing to Noriko Yokozuka, General Counsel and Secretary of the Company, at Perimeter Solutions, SA, 12E, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg or 8000 Maryland Ave. Suite 350, Clayton, Missouri 63105. The Company’s filings with the SEC are also available, without charge, through the Investor Relations — SEC Filings link on the Company’s website, www.perimeter-solutions.com, as soon as reasonably practical after filing. The Company’s website and the information contained therein or connected thereto are not incorporated into this notice.

We have elected to use the “Notice and Access” method of providing our proxy materials over the internet. Accordingly, we mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report on or about May 2, 2022.

Our proxy statement and annual report are available online at www.proxydocs.com/PRM.

Table of Contents

2

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

1.WHY AM I RECEIVING THESE PROXY MATERIALS?

You are receiving these proxy materials because you held ordinary shares (the “Ordinary Shares”) of Perimeter Solutions, SA, a public limited liability company duly incorporated and validly existing under the laws of the Grand Duchy of Luxembourg, having its registered office at 12E, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg and registered with the Registre de Commerce et des Sociétés, Luxembourg (Luxembourg Trade and Companies Register) under number B 256.548 (the “Company,” “our,” “we” or “us”) on April 14, 2022, the record date (the “Record Date”) for the 2022 Annual Meeting of Shareholders (the “Annual Meeting”), to be held online via a live webcast, at 8:00 a.m. (CDT), on July 21, 2022. As a shareholder of record as of the Record Date, you are entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. To participate in the Annual Meeting, you must pre-register at www.proxydocs.com/PRM by 5:00 p.m. (CDT), on July 20, 2022. Upon completing your pre-registration, you will receive further instructions via email, including your unique link that will allow you access to the Annual Meeting and will also permit you to submit questions prior to the Annual Meeting.

The proxy materials include our Notice of 2022 Annual Meeting of Shareholders, Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2021. The proxy materials also include the proxy card for the Annual Meeting, which is being solicited on behalf of the Board of Directors of the Company (the “Board”). The proxy materials contain detailed information about the matters to be voted on at the Annual Meeting and provide updated information about the Company to assist you in making an informed decision when voting your shares.

The Company began furnishing the proxy materials to shareholders on or about May 2, 2022 and will bear the cost of soliciting proxies on behalf of the Company for the Annual Meeting.

2.WHO IS PARTICIPATING IN THIS SOLICITATION?

The Company has retained Georgeson LLC (the “Solicitor”) to aid in the solicitation of proxies and to verify certain records related to the solicitation subject to customary terms and conditions. The Company will bear the cost of soliciting proxies for the Annual Meeting. The Company will pay Solicitor a fee of $12,500 as compensation for its services and will reimburse it for its reasonable out-of-pocket expenses. Our officers and certain of our employees may also solicit proxies by mail, telephone, e-mail or facsimile transmission. They will not be paid additional remuneration for their efforts. Upon request, we will reimburse brokers, dealers, banks and trustees, or their nominees, for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of Ordinary Shares.

3.WHO IS ENTITLED TO VOTE AT THE MEETING?

Owners of Ordinary Shares as of the close of business on the Record Date are entitled to vote at the Annual Meeting. Ordinary Shares owned by you include shares you held on the Record Date (i) directly in your name as the shareholder of record (registered shareholder) and (ii) in the name of a broker, bank or other holder of record where the shares were held for you as the beneficial owner (in “street name”). Each ordinary share is entitled to one vote on each matter. As of the Record Date, there were 163,234,542 Ordinary Shares outstanding and entitled to vote. There are no other outstanding voting securities of the Company entitled to vote at the Annual Meeting. A complete list of shareholders entitled to vote at the Annual Meeting will be open to the examination of any shareholder during normal business hours for ten days prior to the Annual Meeting at (i) the registered office of the Company, at 12E, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg and (ii) the Company’s offices at 8000 Maryland Ave. Suite 350, Clayton, Missouri 63105 and virtually at the Annual Meeting.

4.HOW DO I VOTE MY SHARES?

If you are a shareholder of record as of the Record Date, you may vote by any of the following methods:

•Voting by Mail. If you choose to vote by mail, simply complete the enclosed proxy card, date and sign it, and return it in the postage-paid envelope provided. Your shares will be voted in accordance with the instructions on your proxy card.

3

•Voting by Internet. You may vote through the internet by signing on to the website identified on your proxy card and following the procedures described on the website. Internet voting is available 24 hours a day, and the procedures are designed to authenticate votes cast by using a personal identification number located on your proxy card. The procedures permit you to give a proxy to vote your shares and to confirm that your instructions have been properly recorded. If you vote by internet, you should not return your proxy card.

•Voting by Telephone. You may vote your shares by telephone by calling the toll-free telephone number provided on your proxy card. Telephone voting is available 24 hours a day, and the procedures are designed to authenticate votes cast by using a personal identification number located on your proxy card. The procedures permit you to give a proxy to vote your shares and to confirm that your instructions have been properly recorded. If you vote by telephone, you should not return your proxy card.

If your shares are held by a bank, brokerage firm or other nominee, you are considered the “beneficial owner” of shares held in “street name.” If your shares are held in street name, the Notice of Internet Availability of Proxy Materials (including a voting instruction form) are being forwarded to you by your bank, brokerage firm, or other nominee (the “bank or broker”). As the beneficial owner, you have the right to direct your bank or broker how to vote your shares by following the instructions on the Notice of Internet Availability of Proxy Materials or voting instruction form for voting on the internet or by telephone (if made available by your bank or broker with respect to any shares you hold in street name), or by completing and returning the voting instruction form, and the bank or broker is required to vote your shares in accordance with your instructions. You are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote these shares at the meeting unless you follow the instructions below under “How do I obtain admission to the Annual Meeting?”.

5.CAN I REVOKE MY PROXY OR CHANGE MY VOTE?

Yes. You may revoke your proxy at any time prior to its exercise at the Annual Meeting. If you attend the Annual Meeting, you may change your vote at any time until the polls are closed at the Annual Meeting. You may change your vote by either: (i) granting a new proxy bearing a later date (which automatically revokes the earlier proxy) whether made via the internet, by telephone or by mail; (ii) if you are a shareholder of record, notifying the Secretary in writing at the registered office of the Company at 12E, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg or at the Company’s offices at 8000 Maryland Ave. Suite 350, Clayton, Missouri 63105 that you want to revoke your earlier proxy; or (iii) if you are attending the Annual Meeting virtually and vote by ballot during the meeting. Your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote by ballot during the Annual Meeting.

If you hold your shares in street name, you may change your vote by contacting your broker or other nominee and following their instructions.

6.HOW WILL MY SHARES BE VOTED IF I SUBMIT A PROXY CARD BUT DO NOT SPECIFY HOW I WANT TO VOTE?

If you sign your proxy card and return it without marking any voting instructions, your shares will be voted at the Annual Meeting or any adjournment or postponement thereof:

•“FOR” the election of all director nominees recommended by our Board (Proposal 1);

•“FOR” Proposals 2 through 8; and

•in the discretion of the persons named as proxies on all other matters that may properly come before the Annual Meeting or any adjournment or postponement thereof.

Despite this, our Board strongly urges you to mark your proxy card in accordance with our Board’s recommendations.

7.HOW DO I OBTAIN ADMISSION TO THE ANNUAL MEETING?

Attendance at the Annual Meeting will be limited to Company shareholders as of the Record Date, those holding proxies from shareholders and representatives of the Company, press and financial community. You will not be able to attend the Annual Meeting in person at a physical location. In order to attend the virtual meeting, you will

4

need to pre-register by 5:00 p.m. (CDT), on July 20, 2022. To pre-register for the meeting, please follow these instructions:

Registered Shareholders

Shareholders of record as of the Record Date may register to participate in the Annual Meeting remotely by visiting the website www.proxydocs.com/PRM. Please have your proxy card, or Notice of Internet Availability of Proxy Materials, containing your control number available and follow the instructions to complete your registration request. After registering, shareholders will receive a confirmation email with a link and instructions for accessing the virtual Annual Meeting. Requests to register to participate in the Annual Meeting remotely must be received no later than 5:00 p.m. (CDT), on July 20, 2022.

Beneficial Shareholders

Shareholders whose shares are held through a broker, bank or other nominee as of the Record Date may register to participate in the Annual Meeting remotely by visiting the website www.proxydocs.com/PRM.

Please have your voting instruction form, Notice of Internet Availability of Proxy Materials, or other communication from your broker, bank or other nominee containing your control number available and follow the instructions to complete your registration request. After registering, shareholders will receive a confirmation email with a link and instructions for accessing the virtual Annual Meeting. Requests to register to participate in the Annual Meeting remotely must be received no later than 5:00 p.m. (CDT), on July 20, 2022.

If you want to vote your Ordinary Shares held in street name at the virtual meeting, you must get a legal proxy in your name from the bank, broker or other nominee that holds your shares of stock, in PDF or image file format (.jpg, .gif or .png) and submit it with your vote.

Questions on How to Pre-register

In order to attend the Annual Meeting, you must pre-register at www.proxydocs.com/PRM. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting and to vote and submit questions during the Annual Meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

On the day of the Annual Meeting, July 21, 2022, shareholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the Annual Meeting. The Annual Meeting will begin promptly at 8:00 a.m. (CDT).

8. MAY I ASK QUESTIONS AT THE ANNUAL MEETING?

Yes. Shareholders will have the ability to submit questions in writing during the Annual Meeting via the annual meeting portal. As part of the Annual Meeting, we will hold a live question and answer session, during which we intend to answer questions submitted during the meeting that are pertinent to the Company and the business of the meeting, as time permits. Rules of Conduct for the Annual Meeting, including the types of questions that the Company does not intend to address will be available on our website at www.perimeter-solutions.com prior to the meeting, and on the meeting portal on the day of the meeting. Examples of questions that are not pertinent are questions related to general economic, political or other views that are not directly related to the business of the Annual Meeting, questions related to personal grievances and derogatory references to individuals.

If there are pertinent questions that cannot be answered during the Annual Meeting due to time constraints, we will post answers to a representative set of such questions (e.g., consolidating duplicative questions) on our website at www.perimeter-solutions.com. The questions and answers will be made available as soon as practicable after the Annual Meeting.

5

9. WHAT IF I HAVE TECHNICAL DIFFICULTIES OR TROUBLE ACCESSING THE ANNUAL MEETING?

We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the virtual-only Annual Meeting platform, including any difficulties voting or submitting questions, you may call the technical support number that will be posted in your instructional email.

10. WHAT CONSTITUTES A QUORUM AT THE ANNUAL MEETING?

One half of the outstanding shares of the Company entitled to vote at the Annual Meeting, present in person or by proxy, will constitute a quorum, which is the minimum number of shares that must be present or represented by proxy at the meeting to transact business. All the ordinary shares present or represented will be counted as present to determine whether a quorum has been established.

11. WHAT IS THE VOTING REQUIREMENT TO APPROVE EACH OF THE PROPOSALS?

Seven directors will be elected at the Annual Meeting. The affirmative vote of a majority of the votes cast is required for a director nominee to be elected. You may vote “FOR” or “AGAINST” or “ABSTAIN” for each director nominee. Abstentions and broker non-votes will have no effect on the vote.

The (i) approval of the appointment of BDO USA, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2022 and BDO Audit SA as the statutory auditor of the Company for the year ending December 31, 2022, (ii) approval of the Annual Accounts, (iii) approval of the Consolidated Financial Statements, (iv) allocation of the results shown in the Annual Accounts, (v) discharge of the directors of the Company for the performance of their mandates as directors of the Company, (vi) approval of the compensation of certain of the non-employee independent directors of the Company for 2021, (vii) approval of the Share Repurchase Program and (viii) any other matter that properly comes before the Annual Meeting will be approved by a majority of the votes cast. You may vote “FOR” or “AGAINST” or “ABSTAIN” from voting for each of these proposals. Abstentions and broker non-votes will have no effect on the vote.

12. WHAT HAPPENS IF I HOLD SHARES IN STREET NAME AND DO NOT SUBMIT VOTING INSTRUCTIONS? WHAT IS A BROKER NON-VOTE?

A broker non-vote occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker or nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Under applicable rules that govern brokers who are voting with respect to shares held in street name, brokers ordinarily have the discretion to vote on “routine” matters (e.g., approval of the selection of independent public accountants) but not on non-routine matters (e.g., election of directors).

13. WHERE CAN I FIND VOTING RESULTS OF THE ANNUAL MEETING?

We will announce the voting results for the proposals at the Annual Meeting and publish final detailed voting results in a Form 8-K filed with the Securities and Exchange Commission (the “SEC”) within four business days after the Annual Meeting.

14. WHO SHOULD I CONTACT IF I HAVE ANY QUESTIONS OR NEED ASSISTANCE IN VOTING MY SHARES, OR IF I NEED ADDITIONAL COPIES OF THE PROXY MATERIALS?

If you have any questions, please contact Solicitor toll-free at (888) 566-8006. Banks and brokers may call at (888) 566-8006.

6

PROXY SUMMARY

Annual Meeting

| Date: | July 21, 2022 | ||||

| Time: | 8:00 a.m. (CDT) | ||||

| Place: | The meeting will be virtual and can be accessed by pre-registering at www.proxydocs.com/PRM | ||||

| Record Date: | April 14, 2022 | ||||

Voting Matters and Board Recommendations

| Matter | Board Recommendation | Page | ||||||||||||||||||

| No. 1 | Election of Directors | FOR each Director Nominee | ||||||||||||||||||

| No. 2 | Approval of the appointment of BDO USA, LLP as Independent Auditor and BDO Audit SA as Statutory Auditor | FOR | ||||||||||||||||||

| No. 3 | Approval of Annual Accounts | FOR | ||||||||||||||||||

| No. 4 | Approval of Consolidated Financial Statements | FOR | ||||||||||||||||||

| No. 5 | Allocation of results shown in Annual Accounts | FOR | ||||||||||||||||||

| No. 6 | Discharge of the directors | FOR | ||||||||||||||||||

| No. 7 | Approval of compensation to certain non-employee independent directors | FOR | ||||||||||||||||||

| No. 8 | Approval and Ratification of Share Repurchase Program | FOR | ||||||||||||||||||

Overview and 2021 Financial Highlights

We are a leading global solutions provider, producing high-quality firefighting products and lubricant additives. We develop products that impact critically important issues of life—issues where there often is no room for error and the job doesn’t offer second chances. We characterize the solutions we develop as ‘Solutions that Save’—which helps underscore what we are trying to accomplish for our customers and the world at large, across our business segments.

On November 9, 2021, the Company consummated the transactions contemplated by the business combination agreement, dated June 15, 2021, by and among the Company, EverArc Holdings Limited (“EverArc”), EverArc (BVI) Merger Sub Limited, and SK Invictus Holdings S.à r.l. (the “Business Combination”). In June 2021, Haitham Khouri and Vivek Raj were elected to serve as directors of the Company with terms expiring at the 2027 Annual Meeting of Shareholders, or until their respective successors are elected and qualified and on November 8, 2021, W. Nicholas Howley, William N. Thorndike, Jr., Edward Goldberg, Tracy Britt Cool, Kevin Stein, Sean Hennessy and Robert S. Henderson were elected to serve as directors of the Company with terms expiring at the Annual Meeting, or until their respective successors are elected and qualified. Kevin Stein served as a director of the Company from November 2021 until his decision not to continue as a director in April 2022. Mr. Stein was replaced by Bernt Iversen II in April 2022.

7

A summary of the 2021 financial highlights of the Company are as follows:

•Net sales increased 7% to $362.3 million in 2021, as compared to $339.6 million in 2020.

▪Fire Safety sales increased 7% to $261.2 million, as compared to $245.0 million in 2020.

▪Oil Additives sales increased 7% to $101.2 million, as compared to $94.6 million in 2020.

•Net loss for 2021 was $659.8 million, or $(9.68) per share, a decrease of $684.1 million from net income of $24.2 million, or $0.46 per share for 2020, due to a $653.0 million compensation expense recognized by the Company related to the total amounts payable under the Founder Advisory Agreement (as defined below).

•Adjusted EBITDA increased 4% to $141.4 million in 2021, as compared to $136.0 million in 2020.

▪Fire Safety Adjusted EBITDA increased 5% to $117.9 million, as compared to $112.0 million in 2020.

▪Oil Additives Adjusted EBITDA decreased 2% to $23.5 million, as compared to $24.0 million in 2020.

Board and Governance Highlights

Assuming election of all of the director nominees, the following is a list of persons who will constitute the Board following the Annual Meeting, including their current committee assignments.

| Board of Directors | ||||||||||||||||||||

| Name | Age | Independence | Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

Executive Committee | ||||||||||||||

| W. Nicholas Howley | 70 | ✓ | ||||||||||||||||||

| William N. Thorndike, Jr. | 58 | ✓ | ||||||||||||||||||

Haitham Khouri(1)

|

41 | ✓* | ||||||||||||||||||

| Edward Goldberg | 59 | |||||||||||||||||||

Vivek Raj(1)

|

38 | ✓ | ✓ | ✓ | ||||||||||||||||

| Tracy Britt Cool | 37 | ✓ | ✓ | |||||||||||||||||

| Sean Hennessy | 64 | ✓ | ✓* | ✓ | ||||||||||||||||

| Robert S. Henderson | 65 | ✓ | ✓ | ✓ | ✓* | |||||||||||||||

| Bernt Iversen II | 64 | ✓ | ✓ | ✓* | ||||||||||||||||

* Denotes the Chair of the committee.

(1) Messrs. Khouri and Raj were elected to serve as directors of the Company in June 2021 with terms expiring at

the 2027 Annual Meeting of Shareholders, or until their respective successors are elected and qualified;

therefore, Messrs. Khouri and Raj are not nominated for election at the Annual Meeting.

Kevin Stein served as a director of the Company from November 2021 until his decision not to continue as a director in April 2022. Mr. Stein was replaced by Mr. Iversen in April 2022. Mr. Stein served as the Chair of the Compensation Committee and as a member of the Audit Committee.

We are committed to principles of effective corporate governance and to high ethical standards, as well as compliance with all applicable governance standards of the SEC and New York Stock Exchange (the “NYSE”). Highlights of the framework we have established for governance are outlined here, and further described below.

8

|

Independence and Qualification

of Committee Members

|

The Audit, Compensation and Nominating and Governance Committees of the Board are comprised of all Independent Directors.

All directors on committees meet the applicable qualification requirements of the SEC and NYSE.

|

||||

| Non-Classified Board | The Board is non-classified. | ||||

Leadership Structure |

The offices of the Chief Executive Officer and Co-Chairmen of the Board are separated. | ||||

Risk Oversight |

The Board is responsible for the oversight of risk, including overseeing the assessment of risk and the appropriate balance of risk mitigation and the appropriate taking of risk.

These risk assessment and balancing tasks are also the responsibility of the Board’s committees and the Company’s management team.

|

||||

Open Communication |

We encourage communication and solid working relationships among our Co-Chairmen of the Board, Directors, and the Chief Executive Officer.

Our directors have access to the management team and employees.

|

||||

Stock Retention Guidelines |

Our executive officers are required to hold a minimum level of personal investment in the Company pursuant to stock retention guidelines attached to each of their option agreements. |

||||

Board and Committee Evaluations |

We engage in an annual review of both our Board and its Committees, led by the Chair of the Nominating and Corporate Governance Committee. | ||||

Committee Reports |

Our Committees report their activities to our Board at each Board meeting to ensure oversight and accountability. | ||||

Shareholder Voice |

Shareholders and other interested parties can contact our Directors individually or as a group through written communication.

Directors are elected by a majority of the votes cast.

|

||||

Certain Proposals Mandated by Luxembourg Law

Proposals 2 through 8 on which you are being asked to vote are customary or required for public limited liability companies (société anonyme) incorporated under Luxembourg law to present to shareholders at each annual meeting. These proposals may be unfamiliar to shareholders accustomed to proxy statements for companies organized in other jurisdictions. For more detailed information on these proposals, please see pages 30 through 36.

9

PROPOSAL 1 - ELECTION OF DIRECTORS

Luxembourg law and our articles of association (“Articles”) permit our shareholders to fix the size of the Board. At the date of this Proxy Statement, our Board is comprised of nine directors, seven of whom are non-employee directors and five of whom are independent.

The Board is committed to recruiting and nominating directors for election who will collectively provide the Board with the necessary diversity of experiences, skills and characteristics to enhance the Board’s ability to manage and direct the affairs and business of the Company and to make fully informed, comprehensive decisions. In recommending candidates for election to the Board, in the context of the perceived needs of the Board at that time, the Nominating and Corporate Governance Committee evaluates a candidate’s knowledge, experience, skills, expertise and diversity, and any other factors that the Nominating and Corporate Governance Committee deems relevant. In particular, the Board and the Nominating and Corporate Governance Committee believe that the Board should be comprised of a well-balanced group of individuals.

In 2022, the Nominating and Corporate Governance Committee unanimously recommended to the Board, and the Board unanimously approved the recommendations from the Nominating and Corporate Governance Committee, the nomination of W. Nicholas Howley, William N. Thorndike, Jr., Edward Goldberg, Tracy Britt Cool, Sean Hennessy, Robert S. Henderson and Bernt Iversen II to the Board, each to hold office until the 2023 Annual Meeting of Shareholders or until a successor has been duly elected and qualified. Each nominee has consented to serve if elected. Messrs. Khouri and Raj were elected to serve as directors of the Company in June 2021 with terms expiring at the 2027 Annual Meeting of Shareholders, or until their respective successors are elected and qualified; therefore, Messrs. Khouri and Raj are not nominated for election at the Annual Meeting.

Shareholder Vote Requirement

The affirmative vote of a majority of the votes cast is required for a director nominee to be elected. You may vote “FOR” or “AGAINST” or “ABSTAIN” for each director nominee. Abstentions and broker non-votes will have no effect on the vote.

Recommendation of the Board

Our Board recommends that shareholders vote “FOR” the seven nominees recommended by the Board.

Director Nominees

The following persons are our Board’s nominees for election to serve as directors. There are no family relationships between any of the director nominees. Certain information relating to our Board’s nominees, furnished by the nominees, is set forth below. The ages set forth below are accurate as of the date of this Proxy Statement.

Our Board has determined that all of its nominees are qualified to serve as directors of the Company. In addition to the specified business experience listed below, each of the directors has the background skills and attributes which the Board believes are required to be an effective director of the Company, including experience at senior levels in areas of expertise helpful to the Company, a willingness and commitment to assume the responsibilities required of a director of the Company and the character and integrity the Board expects of its directors.

| W. NICHOLAS HOWLEY |

Director since 2021

Age 70

|

||||

Mr. Howley has served as Co-Chairman of the Board since November 2021. Mr. Howley co-founded TransDigm Group Inc. (“TransDigm”), a NYSE-listed aerospace manufacturing company, in 1993 and has served as the Chairman of TransDigm’s board of directors since 2003 and as Executive Chairman from 2018 to 2021. Mr. Howley served as President and/or Chief Executive Officer of TransDigm from 2003 through 2018 and as President and/or Chief Executive Officer of TransDigm Inc. from 1998 through 2018. Mr. Howley holds a B.S. degree in mechanical engineering from Drexel University and an M.B.A. degree from Harvard Business School.

Qualifications. We believe Mr. Howley’s qualifications to serve on our Board include his executive leadership experience, experience as a member of other corporate boards, and his knowledge of public companies.

10

| WILLIAM N. THORNDIKE, JR. |

Director since 2021

Age 58

|

||||

Mr. Thorndike has served as Co-Chairman of our Board since November 2021. Mr. Thorndike founded Housatonic Partners, a leading middle market private equity firm with offices in Boston and San Francisco, in 1994 and has been a Managing Director since that time. Prior to founding Housatonic Partners, Mr. Thorndike worked with T. Rowe Price Associates, a global asset management firm, and Walker & Company, a publishing company, where he was named to its board of directors. Mr. Thorndike has served as a director of over 30 companies since founding Housatonic Partners. He is currently a director of CNX Resources Corporation, a natural gas company, and serves on various boards of directors of private companies. He also serves as a Trustee of WGBH, a public broadcaster serving southern New England, and the College of the Atlantic. Mr. Thorndike is the author of “The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success,” which has been translated into 12 languages. Mr. Thorndike holds an A.B. degree in English and American Literature from Harvard University and an M.B.A. degree from Stanford University.

Qualifications. We believe Mr. Thorndike’s qualifications to serve on our Board include his extensive finance and investment experience, experience as a member of other corporate boards, and his knowledge of public companies.

| EDWARD GOLDBERG |

Director since 2021

Age 59

|

||||

Mr. Goldberg has served as a member of our Board and as our Chief Executive Officer since November 2021. Mr. Goldberg joined SK Invictus Intermediate S.à r.l. (d/b/a Perimeter Solutions) (“SK Invictus”) in March 2018 as Chief Executive Officer and brings more than 18 years of executive leadership to fire safety products and operations. Before joining SK Invictus, Mr. Goldberg was Business Director for ICL Performance Additives and Solutions, where he held general management responsibility for the company’s global fire safety segment. Mr. Goldberg is credited with building ICL’s global fire safety business, focusing on products for wildland fire management and municipal and industrial fire suppression. Mr. Goldberg holds a BS in Chemical Engineering from Cornell University.

Qualifications. We believe Mr. Goldberg’s qualifications to serve on our Board include his extensive knowledge of SK Invictus and his years of executive leadership at SK Invictus.

| TRACY BRITT COOL |

Director since 2021

Age 37

|

||||

Ms. Britt Cool has served as a member of our Board since November 2021. In 2020, Ms. Britt Cool co-founded Kanbrick, a long-term investment partnership focused on acquiring and building great companies in the consumer and industrial sectors. At Kanbrick, Ms. Britt Cool combines her passion for long-term value investing with her experience as an entrepreneurial-minded operator to help take mid-size companies to the next level. From 2009 to 2020, Ms. Britt Cool worked at Berkshire Hathaway, where she spent five years at Berkshire Hathaway’s headquarters in Omaha as the Financial Assistant to the Chairman and five years as Chief Executive Officer of Pampered Chef, a Berkshire Hathaway subsidiary based in Chicago. At Pampered Chef, a provider of kitchenware products, Ms. Britt Cool turned around a decade long decline and achieved meaningful growth in revenue and earnings. Additionally, Ms. Britt Cool served on the boards of directors of several Berkshire Hathaway companies including Kraft Heinz, Benjamin Moore, Oriental Trading Company, Larson Juhl, and Johns Manville. Ms. Britt Cool is the co-founder of Smart Woman Securities, an organization that provides personal finance and investment education to undergraduate women. Ms. Britt Cool holds an A.B. degree in economics from Harvard College and an M.B.A. degree from Harvard Business School.

Qualifications. We believe Ms. Britt Cool’s qualifications to serve on our Board include her executive leadership experience particularly in setting strategic direction and developing and executing financial and operating strategies, experience as an investor in private and public companies, and experience as a member of other corporate boards.

11

| SEAN HENNESSY |

Director since 2021

Age 64

|

||||

Mr. Hennessy has served as a member of our Board since 2021. Mr. Hennessy is the retired Senior Vice President, Corporate Planning, Development & Administration of The Sherwin Williams Company, a manufacturer and distributor of coatings and related products, serving in that role from January 2017 to March 2018 in connection with the company’s integration of its Valspar acquisition. Prior to that Mr. Hennessy served as Chief Financial Officer of The Sherwin Williams Company from 2001 to 2016. He is a certified public accountant. Mr. Hennessy also serves on the board of directors of TransDigm. Mr. Hennessy holds a Bachelor’s degree from the University of Akron.

Qualifications. We believe Mr. Hennessy qualifications to serve on our Board include his experience as Chief Financial Officer at The Sherwin Williams Company, experience as a member of other corporate boards, and his knowledge of public companies.

| ROBERT S. HENDERSON |

Director since 2021

Age 65

|

||||

Mr. Henderson has served as a member of our Board since November 2021. Mr. Henderson served as the Vice Chairman at TransDigm from 2017 to 2021. He also served as the COO of TransDigm’s Airframe Segment from 2014 to 2016 and as Executive Vice President from 2005 to 2014. From 1999 to 2008 he also served as President of AdelWiggins Group, a division of TransDigm. Mr. Henderson has significant experience integrating acquisitions and leading multiple operating units concurrently. Mr. Henderson holds a Bachelor’s degree in Mathematics from Brown University.

Qualifications. We believe Mr. Henderson’s qualifications to serve on our Board include his experience as Vice Chairman at TransDigm, his executive leadership experience, and his knowledge of public companies.

| BERNT IVERSEN II |

Director Nominee

Age 64

|

||||

Mr. Iversen served as Executive Vice President – Mergers & Acquisitions and Business Development of TransDigm from May 2012 to December 2020. Prior to that, Mr. Iversen served as Executive Vice President of TD Group from December 2010 through May 2012 and as President of Champion Aerospace LLC, a wholly-owned subsidiary of TransDigm Inc., from June 2006 to December 2010. Mr. Iversen holds a Bachelor’s Degree in Engineering from Western Michigan University.

Qualifications. We believe Mr. Iversen’s qualifications to serve on our Board include his experience as Executive Vice President at TransDigm, his executive leadership experience, and his knowledge of public companies.

Directors Appointed Until 2027 Annual Meeting of Shareholders

The following persons were elected to serve as directors of the Company with terms expiring at the 2027 Annual Meeting of Shareholders, or until their respective successors are elected and qualified. Certain information relating to these directors, furnished by the directors, is set forth below. The ages set forth below are accurate as of the date of this Proxy Statement.

| HAITHAM KHOURI |

Director since 2021

Age 41

|

||||

Mr. Khouri has served as a member of our Board since June 2021 and has served as Vice Chairman of the Company since December 2021. Mr. Khouri was a Senior Analyst at Hound Partners from 2009 to 2018. Between 2005 and 2007 Mr. Khouri was a private equity Associate at Oak Hill Capital Partners. Between 2003 and 2005 Mr. Khouri was an investment banking analyst at Deutsche Bank. Mr. Khouri began his career in 2002 as an Analyst at JP Morgan. Mr. Khouri holds a BA in Economics from Cornell University and an MBA with Distinction from Harvard Business School.

Qualifications. We believe Mr. Khouri’s qualifications to serve on our Board include his experience

12

as an investor in private and public companies.

| VIVEK RAJ |

Director since 2021

Age 38

|

||||

Mr. Raj has served as a member of our Board since June 2021. Mr. Raj founded Geneses Investments, a private investment firm, in 2018. Mr. Raj was a private equity investor between 2011 and 2018 and before that held operational roles in the energy industry. Mr. Raj holds a Bachelor of Technology from the Indian Institute of Technology, Delhi and an MBA from Harvard Business School.

Qualifications. We believe Mr. Raj’s qualifications to serve on our Board include his experience as an

investor in private companies, experience as a member of other corporate boards, and his operating

experience.

13

CORPORATE GOVERNANCE

Introduction

Prior to November 8, 2021, the Board consisted of Messrs. Khouri and Raj and prior to the consummation of the Business Combination on November 9, 2021, the Company had no operations. On November 1, 2021, with effect as of November 8, 2021 the Board (i) appointed members to the Board’s four committees (the “Committees”) and (ii) adopted the charters of the Committees. On November 8, 2021, the day immediately prior to the consummation of the Business Combination, the shareholders of the Company appointed seven additional members to the Board.

Meetings

During 2021, the Board held one meeting and adopted various resolutions by means of written consent. Each incumbent director attended 100% of the aggregate of (i) the total number of meetings of the Board during the period for which he or she was a director and (ii) the total number of meetings of all Committees on which he or she served during the period for which he or she was a director.

Corporate Governance Guidelines

Our Board is responsible for overseeing the management of our Company. Our Board has adopted Corporate Governance Guidelines (the “Governance Guidelines”), which set forth our governance principles and policies relating to, among other things:

•director independence;

•director qualifications and responsibilities;

•board structure and meetings;

•management succession; and

•the performance evaluation of our Board.

Our Governance Guidelines are available in the Investor Relations section of our website at www.perimeter-solutions.com.

Board Leadership Structure

The Board has not adopted a formal policy regarding the need to separate or combine the offices of Chief Executive Officer and Chairman of the Board and instead the Board remains free to make this determination from time to time in a manner that seems most appropriate for the Company. Although the Board recognizes the benefits of having a combined Chairman and Chief Executive Officer, currently, we separate the positions of our Chief Executive Officer and Co-Chairmen of the Board in recognition of the differences between the two roles. The Chief Executive Officer is responsible for the day-to-day leadership and performance of the Company, while the Co-Chairmen of the Board provide strategic guidance to the Chief Executive Officer and set the agenda for and preside over the Board meetings. In addition, we believe that the current separation provides a more effective monitoring and objective evaluation of the Chief Executive Officer’s performance. The separation also allows the Co-Chairmen of the Board to strengthen the Board’s independent oversight of our performance and governance standards.

Director Independence

Our Board reviews the independence of the current and potential members of the Board in accordance with independence requirements set forth in the NYSE rules and applicable provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). During its review, the Board considers transactions and relationships between each director and potential director, as well as any member of his or her immediate family, and the Company and its affiliates, including those related-party transactions contemplated by Item 404(a) of Regulation S-K under the Exchange Act. The Board must affirmatively determine that the director has no material relationship with the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company, that, in the opinion of the Board, would interfere with the exercise of the director’s independent judgment in carrying out the responsibilities of a director. The purpose of this review is to determine whether any

14

such relationships or transactions exist that are inconsistent with a determination that the director is independent. Our Board has determined that all nominees except Messrs. Goldberg, Howley, Khouri and Thorndike are “independent” as such term is defined by NYSE rules, our corporate governance standards and the federal securities laws.

Board Committees

Our Board has four standing committees: Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Executive Committee. Copies of the committee charters of each of the committees setting forth the responsibilities of the committees are available on our website. Information contained in, or accessible through, our website is not a part of, and is not incorporated into, this prospectus. The committees will periodically review their respective charters and recommend any needed revisions to our Board. Assuming election of all of the director nominees, the following is a list of persons who will constitute the Board following the Annual Meeting, including their current committee assignments.

| Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Executive Committee | ||||||||||

| Tracy Britt Cool | ✓ | |||||||||||||

| Edward Goldberg | ||||||||||||||

| Robert S. Henderson | ✓ | ✓ | ✓* | |||||||||||

| Sean Hennessy | ✓* | ✓ | ||||||||||||

| W. Nicholas Howley | ✓ | |||||||||||||

| Bernt Iversen II | ✓ | ✓* | ||||||||||||

| Haitham Khouri | ✓* | |||||||||||||

| Vivek Raj | ✓ | ✓ | ||||||||||||

| William N. Thorndike, Jr. | ✓ | |||||||||||||

*Denotes the Chair of the committee.

Audit Committee

Number of Meetings from June 21, 2021 (inception) to December 31, 2021: two

Responsibilities. Our Audit Committee operates pursuant to a formal charter that governs the responsibilities of the Audit Committee. Pursuant to the Audit Committee Charter, the Audit Committee is responsible for, among other things:

•appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm;

•discussing with our independent registered public accounting firm their independence from management;

•reviewing, with our independent registered public accounting firm, the scope and results of their audit;

•approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

•overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the annual financial statements that we file with the SEC;

•overseeing our financial and accounting controls and compliance with legal and regulatory requirements;

15

•reviewing our policies on risk assessment and risk management;

•reviewing related person transactions; and

•establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters.

The Audit Committee has the power to investigate any matter brought to its attention within the scope of its duties and to retain counsel for this purpose where appropriate. Pursuant to the Audit Committee Charter, the Audit Committee reviews and pre-approves all audit and non-audit services performed by our independent accountant.

Independence and Financial Expertise. The Board has reviewed the background, experience and independence of the Audit Committee members and based on this review, has determined that each member of the Audit Committee:

•meets the independence requirements of the NYSE governance listing standards;

•meets the enhanced independence standards for audit committee members required by the SEC; and

•is financially literate, knowledgeable and qualified to review financial statements.

In addition, the Board has determined that Mr. Hennessy qualifies as an “audit committee financial expert” under SEC rules.

Compensation Committee

Number of Meetings from June 21, 2021 (inception) to December 31, 2021: one

Responsibilities. Our Compensation Committee operates pursuant to a formal charter that governs the responsibilities of the Compensation Committee. Pursuant to the Compensation Committee Charter, the Compensation Committee is responsible for, among other things:

•reviewing and approving the corporate goals and objectives, evaluating the performance of and reviewing and approving, (either alone or, if directed by the Board, in conjunction with a majority of the independent members of the Board) the compensation of our Chief Executive Officer;

•overseeing an evaluation of the performance of and reviewing and setting or making recommendations to our Board regarding the compensation of our other executive officers;

•reviewing and approving or making recommendations to our Board regarding our incentive compensation and equity-based plans, policies and programs;

•reviewing and approving all employment agreement and severance arrangements for our executive officers

•making recommendations to our Board regarding the compensation of our directors; and

•retaining and overseeing any compensation consultants.

Independence. The Board has reviewed the background, experience and independence of the Compensation Committee members and based on this review, has determined that each member of the Compensation Committee:

•meets the independence requirements of the NYSE governance listing standards;

•meets the independence requirements of the NYSE governance listing standards; and

•meets the enhanced independence standards for compensation committee members established by the SEC.

16

Compensation Committee Interlocks and Insider Participation. None of the members of the Compensation Committee who presently serve or, in the past year, have served on the Compensation Committee has interlocking relationships as defined by the SEC or had any relationships requiring disclosure by the Company under the SEC’s rules requiring disclosure of certain relationships and related party transactions.

The Compensation Committee has the authority to delegate any of its responsibilities to subcommittees as it may deem appropriate in its sole discretion.

Nominating and Corporate Governance Committee

Number of Meetings from June 21, 2021 (inception) to December 31, 2021: one

Responsibilities. Our Nominating and Corporate Governance Committee operates pursuant to a formal charter that governs the responsibilities of the Nominating and Corporate Governance Committee. Pursuant to the Nominating and Corporate Governance Committee Charter, the Nominating and Corporate Governance Committee is responsible for, among other things:

•identifying individuals qualified to become members of our Board, consistent with criteria approved by our Board;

•overseeing succession planning for our Chief Executive Officer and other executive officers;

•periodically reviewing our Board’s leadership structure and recommending any proposed changes to our Board;

•overseeing an annual evaluation of the effectiveness of our Board and its committees; and

•developing and recommending to our Board a set of corporate governance guidelines;

The Nominating and Corporate Governance Committee may, when it deems appropriate, delegate certain of its responsibilities to one or more Nominating and Corporate Governance Committee members or subcommittees.

Independence. The Board has reviewed the background, experience and independence of the Nominating and Corporate Governance Committee members and based on this review, has determined that each member of the Nominating and Corporate Governance Committee meets the independence requirements of the NYSE governance standards and SEC rules and regulations.

Consideration of Director Nominees. The Nominating and Corporate Governance Committee considers possible candidates for nominees for directors from many sources, including shareholders. The Nominating and Corporate Governance Committee evaluates the suitability of potential candidates nominated by shareholders in the same manner as other candidates recommended to the Nominating and Corporate Governance Committee.

In making nominations, the Nominating and Corporate Governance Committee is required to submit candidates who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment and who shall be most effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the shareholders. In evaluating nominees, the Nominating and Corporate Governance Committee is required to take into consideration the following attributes, which are desirable for a member of the Board: leadership, independence, interpersonal skills, financial acumen, business experiences, industry knowledge and diversity of viewpoints. In addition, while we do not have a formal, written diversity policy, the Nominating and Corporate Governance Committee will attempt to select candidates who will assist in making the Board a diverse body. We believe that a diverse group of directors brings a broader range of experiences to the Board and generates a greater volume of ideas and perspectives, and therefore, is in a better position to make complex decisions.

Executive Committee

Number of Meetings from June 21, 2021(inception) to December 31, 2021: three

Responsibilities. Our Executive Committee operates pursuant to a formal charter that governs the responsibilities of the Executive Committee. Pursuant to the Executive Committee Charter, the Executive Committee is responsible for, among other things:

17

•acting on behalf of the Board between Board meetings and while the Board is not in session; and

•providing oversight over and making recommendations to the Board regarding:

▪the Company’s capital allocation and capital markets activities;

▪the Company’s merger, acquisition, divestiture and similar activities;

▪the Company’s overall strategy, including top-level organizational structure and products or markets served;

▪the Company’s public guidance and communications;

▪the compensation of the Company’s Chief Executive Officer;

▪officer succession planning;

▪investor relations activities;

▪periodic business reviews; and

▪such other duties assigned by the Board.

Code of Business Conduct and Ethics

We have adopted a written Code of Business Conduct and Ethics (“Code of Conduct”) that establishes the standards of ethical conduct applicable to all our directors, officers, and employees. In addition, we have adopted a written Code of Ethics for Senior Financial Officers (“Code of Ethics”) applicable to our Chief Executive Officer and senior financial officers. Copies of our Code of Conduct and Code of Ethics are publicly available in the Investor Relations section of our website at www.perimeter-solutions.com. Any waiver of our Code of Ethics with respect to our Chief Executive Officer, Chief Financial Officer, Controller or persons performing similar functions or waiver of our Code of Conduct with respect to our directors or executive officers may only be authorized by our Board and will be disclosed on our website as promptly as practicable, as may be required under applicable SEC and NYSE rules.

Certain Relationships and Related Party Transactions

During 2021, we did not enter into any related party transactions other than as set forth below.

Founder Advisory Agreement

On November 9, 2021, in connection with the consummation of the Business Combination, the Company, EverArc and the EverArc Founders, LLC (“EverArc Founder Entity”) entered into an Assignment and Assumption Agreement (the “Founder Assignment Agreement”) pursuant to which the Company assumed, and agreed to pay, perform, satisfy and discharge in full, all of EverArc’s liabilities and obligations under the previously disclosed advisory services agreement dated December 12, 2019 (the “Founder Advisory Agreement”) between the EverArc Founder Entity and EverArc. Pursuant to the Founder Advisory Agreement and Founder Assignment Agreement, the EverArc Founder Entity provides services to the Company, including strategic and capital allocation advice. The EverArc Founder Entity is owned and operated by William N. Thorndike, Jr., W. Nicholas Howley, Haitham Khouri, Tracy Britt Cool and Vivek Raj (the “Founders”). Each of the Founders serves as a director of the Company and Haitham Khouri also serves as an executive officer of the Company.

In exchange for the services provided under the Founder Advisory Agreement, the EverArc Founder Entity is entitled to receive both a variable amount (the “Variable Annual Advisory Amount”) and a fixed amount (the “Fixed Annual Advisory Amount,” each an “Advisory Amount” and collectively, the “Advisory Amounts”), each as described below:

•Variable Annual Advisory Amount. Effective upon the consummation of the Business Combination through December 31, 2031, and once the Average Price (as defined in the Founder Advisory Agreement) per ordinary share of the Company is at least $10.00 for ten consecutive trading days, the Variable Annual Advisory Amount will be equal in value to:

18

◦in the first year in which the Variable Annual Advisory Amount is payable, (x) 18% of the increase in the market value of one ordinary share of the Company over $10.00 (such increase in market value, the “Payment Price”) multiplied by (y) 157,137,410 Ordinary Shares, the Founder Advisory Agreement Calculation Number; and

◦in the following years in which the Variable Annual Advisory Amount may be payable (if at all), (x) 18% of the increase in Payment Price over the previous year Payment Price multiplied by (y) 157,137,410 Ordinary Shares, the Founder Advisory Agreement Calculation Number.

•Fixed Annual Advisory Amount. Effective upon the consummation of the Business Combination through December 31, 2027, the Fixed Annual Advisory Amount will be equal to 2,357,061 Ordinary Shares (1.5% of the 157,137,410 Ordinary Shares, the Founder Advisory Agreement Calculation Number).

For 2021, the Average Price was $13.6254 per share, resulting in a total variable annual advisory fee for 2021 of 7,525,906 Ordinary Shares, or a value of $102,543,480 (the “2021 Variable Amount”). The EverArc Founder Entity also received the fixed annual advisory amount which was equal to 1.5% of the Founder Advisory Agreement Calculation Number: 2,357,061 Ordinary Shares or a value of $32,115,899 (based on the Average Price for 2021) (the “2021 Fixed Amount” and together with the 2021 Variable Amount, the “2021 Advisory Amounts”). Per the Founder Advisory Agreement, the EverArc Founder Entity elected to receive approximately 60% of the 2021 Advisory Amounts in Ordinary Shares (5,952,992 Ordinary Shares) and approximately 40% of the Advisory Amounts in cash ($53,547,483). William N. Thorndike, Jr., W. Nicholas Howley, Haitham Khouri, Vivek Raj and Tracy Britt Cool hold ownership interests of 33%, 33%, 25%, 7% and 2%, respectively, in the EverArc Founder Entity.

The Founder Advisory Agreement can be terminated at any time (i) by the EverArc Founder Entity if the Company ceases to be traded on the NYSE; or (ii) by the EverArc Founder Entity or the Company if there is (A) a Sale of the Company (as defined in the Founder Advisory Agreement) or (B) a liquidation of the Company.

Subject to certain limited exceptions, the EverArc Founder Entity’s liability for losses in connection with the services provided is excluded and the Company has agreed to indemnify the EverArc Founder Entity and its affiliates in relation to certain liabilities incurred in connection with acts or omissions by or on behalf of the Company or the EverArc Founder Entity. If the Founder Advisory Agreement is terminated under (i) or (ii)(A), the Company will pay the EverArc Founder Entity an amount in cash equal to: (a) the Fixed Annual Advisory Amount for the year in which termination occurs and for each remaining year of the term of the agreement, in each case at the Payment Price; and (b) the Variable Annual Advisory Amount that would have been payable for the year of termination and for each remaining year of the term of the agreement. In each case the Payment Price in the year of termination will be calculated on the basis of the Payment Year ending on the trading day immediately prior to the date of termination, save that in the event of a Sale of the Company, the Payment Price will be calculated on the basis of the amount paid by the relevant third party (or cash equivalent if such amount is not paid in cash). For each remaining year of the term of the agreement the Payment Price in each case will increase by 15% each year. No account will be taken of any Payment Price in any year preceding the termination when calculating amounts due on termination. Payment will be immediately due and payable on the date of termination of the Founder Advisory Agreement. On the entry into liquidation of the Company, an Advisory Amount will be payable in respect of a shortened year which will end on the trading day immediately prior to the date of commencement of liquidation.

The Founder Advisory Agreement is governed by New York law.

Board Role in Risk Management

Our Board is responsible for overseeing our risk management process. Our Board focuses on our general risk management strategy, the most significant risks facing us, and oversees the implementation of risk mitigation strategies by management. Our Audit Committee is also responsible for discussing our policies with respect to risk assessment and risk management.

Communication with the Board

Shareholders and other parties interested in communicating directly with one or more individual directors or with the non-management directors as a group, may do so by writing to the individual director or group, c/o Perimeter Solutions, SA, 12E, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg or 8000 Maryland Ave. Suite 350, Clayton, Missouri 63105, Attention: Corporate Secretary. The Board has directed our

19

corporate secretary to forward shareholder communications to our Co-Chairmen of the Board and any other director to whom the communications are directed. In order to facilitate an efficient and reliable means for directors to receive all legitimate communications directed to them regarding our governance or operations, our corporate secretary will use his or her discretion to refrain from forwarding the following: sales literature; defamatory material regarding us and/or our directors; incoherent or inflammatory correspondence, particularly when such correspondence is repetitive and was addressed previously in some manner; and other correspondence unrelated to the Board’s corporate governance and oversight responsibilities.

20

EXECUTIVE OFFICERS

Set forth below is certain information relating to our current executive officers. Biographical information with respect to Mr. Goldberg is set forth above under “PROPOSAL 1—ELECTION OF DIRECTORS.”

| Name | Age | Title | ||||||||||||

| Edward Goldberg | 59 | Chief Executive Officer and Director | ||||||||||||

| Barry Lederman | 52 | Chief Financial Officer | ||||||||||||

| Ernest Kremling II | 58 | Chief Operating Officer | ||||||||||||

| Shannon Horn | 48 | Business Director | ||||||||||||

| Noriko Yokozuka | 45 | General Counsel | ||||||||||||

| Stephen Cornwall | 58 | Chief Commercial Officer | ||||||||||||

Barry Lederman has served as Chief Financial Officer of the Company since the consummation of the Business Combination in November 2021. Mr. Lederman joined SK Invictus in November 2019 as Chief Financial Officer and brings extensive financial and international experience, having led teams of several public and private companies including the sale of Halo Pharmaceuticals to Cambrex Corporation in 2018. Prior to joining Halo, he served as the CFO for Eisai Inc. and Qualitrol Company LLC. He holds a Master of Business Administration with a dual concentration in Finance and Operations Management and a Bachelor of Science degree in Electrical Engineering, both from the University of Rochester. Mr. Lederman is also a CPA licensed in New Jersey and New York.

Ernest Kremling II has served as Chief Operating Officer of the Company since the consummation of the Business Combination in November 2021. Mr. Kremling joined SK Invictus in January 2021 as Chief Operating Officer and brings extensive chemical industry experience, having held numerous global senior leadership positions at various organizations. Mr. Kremling began his career at Dow where he held roles of increasing responsibility, later holding Executive Leadership positions in Operations / Supply Chain and Business General Management at KMG Chemicals. Before joining SK Invictus, he was Senior Executive for Production, Technology, Safety and Environment for the Americas at Lanxess. He holds a Bachelor of Arts in Chemistry from Hendrix College.

Shannon Horn has served as Business Director of the Company since the consummation of the Business Combination in November 2021. Mr. Horn joined SK Invictus in 2019 as Business Director and brings over 30 years of experience in the fire safety business. Since 2003, Mr. Horn owned and operated First Response Fire and Rescue, River City Fabrication and H&S Transport, which provided services and equipment support to the company’s fire safety business. SK Invictus acquired these three businesses in March 2019. Mr. Horn holds accounting and business degrees from Long Beach City College and Portland State University – School of Business.

Noriko Yokozuka has served as General Counsel of the Company since the consummation of the Business Combination in November 2021. Ms. Yokozuka joined SK Invictus in March 2018 as General Counsel. Prior to joining SK Invictus, Ms. Yokozuka served as General Counsel for ICL Americas. She previously worked as in-house counsel for a healthcare venture capital firm and family office in New York. Ms. Yokozuka started her career with the Investment Management and Corporate groups at Skadden, Arps, Slate, Meagher & Flom. Ms. Yokozuka received her law degree from the University of Virginia – School of Law and her undergraduate degree from Yale University.

Stephen Cornwall has served as Chief Commercial Officer of the Company since the consummation of the Business Combination in November 2021. Mr. Cornwall joined SK Invictus in December 2019 as Chief Commercial Officer and has over 27 years in the chemical industry, from Monsanto to SK Invictus, in various sales and marketing management positions focused on the phosphorus and derivatives product lines. Mr. Cornwall is the past president of the Chemical Club of New England and the Racemics Group, as well as the past chairman and a board member of the Chemical Educational Foundation. He is also the 2012 recipient of the supplier of the year award from the National Association of Chemical Distributors. Mr. Cornwall holds a Bachelor of Arts in Economics from Westminster College.

21

DIRECTOR COMPENSATION

Our non-employee independent director compensation policy, which was adopted on November 8, 2021, immediately prior to the consummation of the Business Combination, provides for the following compensation for our non-employee independent directors:

•Annual Retainer. Each non-employee independent director is paid a retainer of $75,000 per year.

•Committee Fees. Each Committee chairperson is paid a retainer fee per year, as follows: $15,000 to the chairperson of our Audit Committee, $5,000 to the chairperson of our Compensation Committee and $5,000 to the chairperson of our Nominating and Corporate Governance Committee.

•Annual Equity Award. Every year, we will make grants of stock options to each non-employee independent director covering compensation for one fiscal year, granted on the same terms and conditions as those granted to our employees, which vests over five years, subject to the achievement of certain performance conditions. The terms and conditions of these options are discussed in greater detail under “Compensation Overview—Narrative to Summary Compensation Table—Equity Compensation.”

•Reimbursements. In addition, all of our directors are entitled to be reimbursed by the Company for reasonable expenses incurred by them in the course of their directors’ duties relating to us.

Messrs. Howley, Thorndike, Jr. and Khouri will not receive compensation for their service as directors in light of their affiliation and control over the entity which provides advisory services to the Company in exchange for a fee, as described under “Corporate Governance—Certain Relationships and Related Party Transactions—Founder Advisory Agreement.” Mr. Khouri also receives compensation for his services as an executive officer of the Company in his role of Vice Chairman, but such compensation is not for his services as a director and therefore not included in the table below. In addition, Mr. Goldberg, who serves as our Chief Executive Officer, is not entitled to receive compensation for his services as a director.

The table below sets forth the non-employee director compensation for the year ended December 31, 2021.

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards

($)(1)(2)

|

Total ($) |

|||||||||||||||||

| Tracy Britt Cool | 10,833 | 47,075 | 57,908 | |||||||||||||||||

| Robert S. Henderson | 11,556 | 47,075 | 58,631 | |||||||||||||||||

| Sean Hennessy | 13,000 | 47,075 | 60,075 | |||||||||||||||||

| Vivek Raj | 10,833 | 47,075 | 57,908 | |||||||||||||||||

Kevin Stein(3)

|

11,556 | 47,075 | 58,631 | |||||||||||||||||

(1)Represents the aggregate grant date fair values of performance-based stock options granted on December 7, 2021, computed in accordance with FASB ASC Topic 718. For a discussion of valuation assumptions used in calculating the amounts for 2021, see Note 10 to our historical consolidated financial statements for the year ended December 31, 2021 included in our Annual Report on Form 10-K for the year ended December 31, 2021.

(2)The following table sets forth the aggregate number of unexercised stock options to purchase Ordinary Shares outstanding at December 31, 2021 for each of our non-employee directors:

22

| Name | Aggregate Number of Unexercised Stock Options Outstanding at December 31,2021 |

|||||||

| Tracy Britt Cool | 8,750 | |||||||

| Robert S. Henderson | 8,750 | |||||||

| Sean Hennessy | 8,750 | |||||||

| Vivek Raj | 8,750 | |||||||

| Kevin Stein | 8,750 | |||||||

(3) Mr. Stein served as a director from November 2021 until his decision not to continue as a director in April 2022.

23

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT