EX-99.1

Published on September 4, 2024

UBS Global Materials Conference September 4, 2024

2 Certain statements in this presentation and discussion are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are based on Perimeter Solutions, SA’s (the “Company”) expectations, intentions and projections regarding the Company’s future performance, anticipated events or trends and other matters that are not historical facts. Words such as "anticipate," "estimate," "expect," "forecast," "project," "plan," "intend," "believe," "may," "target," "should," or similar expressions are intended to identify these forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding (i) estimates and forecasts of financial, operational and performance metrics, including, but not limited to, Adjusted EBITDA and capital expenditures; (ii) our volume growth expectations, opportunities and strategies and potential positive impact to our financial and operational results; (iii) our long-term assumptions, including our assumptions regarding replication costs; (iv) the opportunity to expand our business through strategic acquisitions consistent with our five target economic criteria; (v) our expectations related to historical volume drivers persisting into the future; (vi) our ability to deliver long-term equity value creation, including M&A-driven value creation; (vii) our expectations related to trends driving the global wildfire business; (viii) our expectations regarding the increasing length of fire seasons; (ix) our expectations regarding forest health, temperature and drought trends; (x) our plans to grow our airtanker fleet; (xi) our expectations regarding the conversion to, and growing use of, fluorine-free technologies; (xii) our plans to expand into the Wildland Urban Interface; (xiii) our plans to expand internationally; and (xiv) our ability to sustainably drive our long-term earnings power; and (xv) expected capital allocation activities including, but not limited to, expectations relating to capital expenditures, acquisitions, dividends and share repurchases. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For further information, please refer to the Company’s reports and filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company does not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), we have included in this presentation Adjusted EBITDA, a non-GAAP financial measure. The reconciliation of this non-GAAP measure to the most directly comparable financial measures calculated and presented in accordance with GAAP can be found in the Appendix to this presentation. Because Adjusted EBITDA excludes certain items as described herein, it may not be indicative of the results that the Company expects to recognize for future periods. As a result, such non-GAAP financial measures should be considered in addition to, and not a substitute for, financial information prepared in accordance with GAAP. Disclaimer

3 Three Key Messages Attractive Businesses Value Creation Strategy Our Goal Retardants/Suppressants/ Specialty Products ▪ Market Leadership Positions ▪ Challenging Markets to Serve o Critical Products Serving Demanding End-Markets o Complex Chemistries o Tightly Integrated Product / Equipment / Service Offerings ▪ Attractive Growth Profiles Operational Value Drivers Capital Allocation and Capital Structure Deliver private-equity like returns with the liquidity of a public market

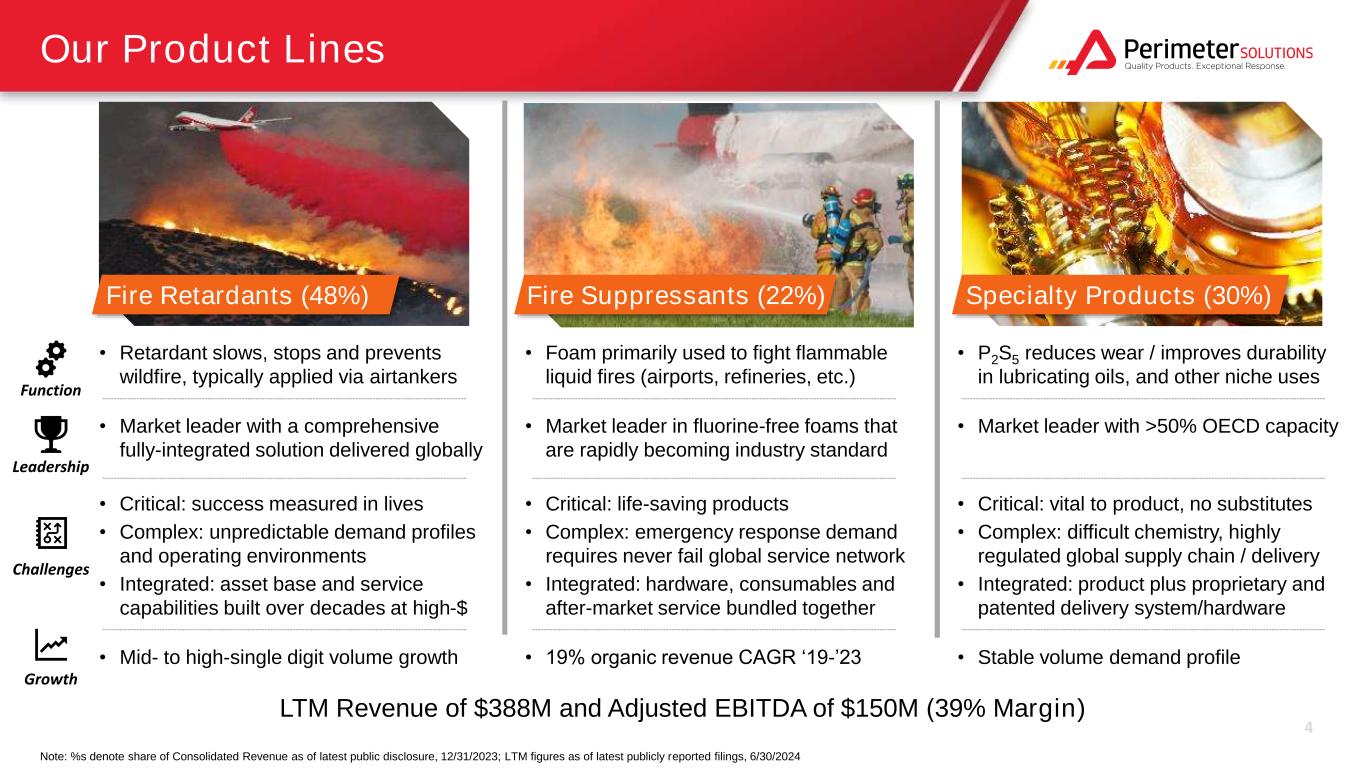

4 Our Product Lines Function Leadership Growth • Retardant slows, stops and prevents wildfire, typically applied via airtankers • P2S5 reduces wear / improves durability in lubricating oils, and other niche uses • Foam primarily used to fight flammable liquid fires (airports, refineries, etc.) • Market leader with a comprehensive fully-integrated solution delivered globally • Market leader with >50% OECD capacity• Market leader in fluorine-free foams that are rapidly becoming industry standard • Critical: success measured in lives • Complex: unpredictable demand profiles and operating environments • Integrated: asset base and service capabilities built over decades at high-$ • Mid- to high-single digit volume growth • Stable volume demand profile• 19% organic revenue CAGR ‘19-’23 Fire Retardants (48%) Fire Suppressants (22%) Specialty Products (30%) LTM Revenue of $388M and Adjusted EBITDA of $150M (39% Margin) Note: %s denote share of Consolidated Revenue as of latest public disclosure, 12/31/2023; LTM figures as of latest publicly reported filings, 6/30/2024 Challenges • Critical: vital to product, no substitutes • Complex: difficult chemistry, highly regulated global supply chain / delivery • Integrated: product plus proprietary and patented delivery system/hardware • Critical: life-saving products • Complex: emergency response demand requires never fail global service network • Integrated: hardware, consumables and after-market service bundled together

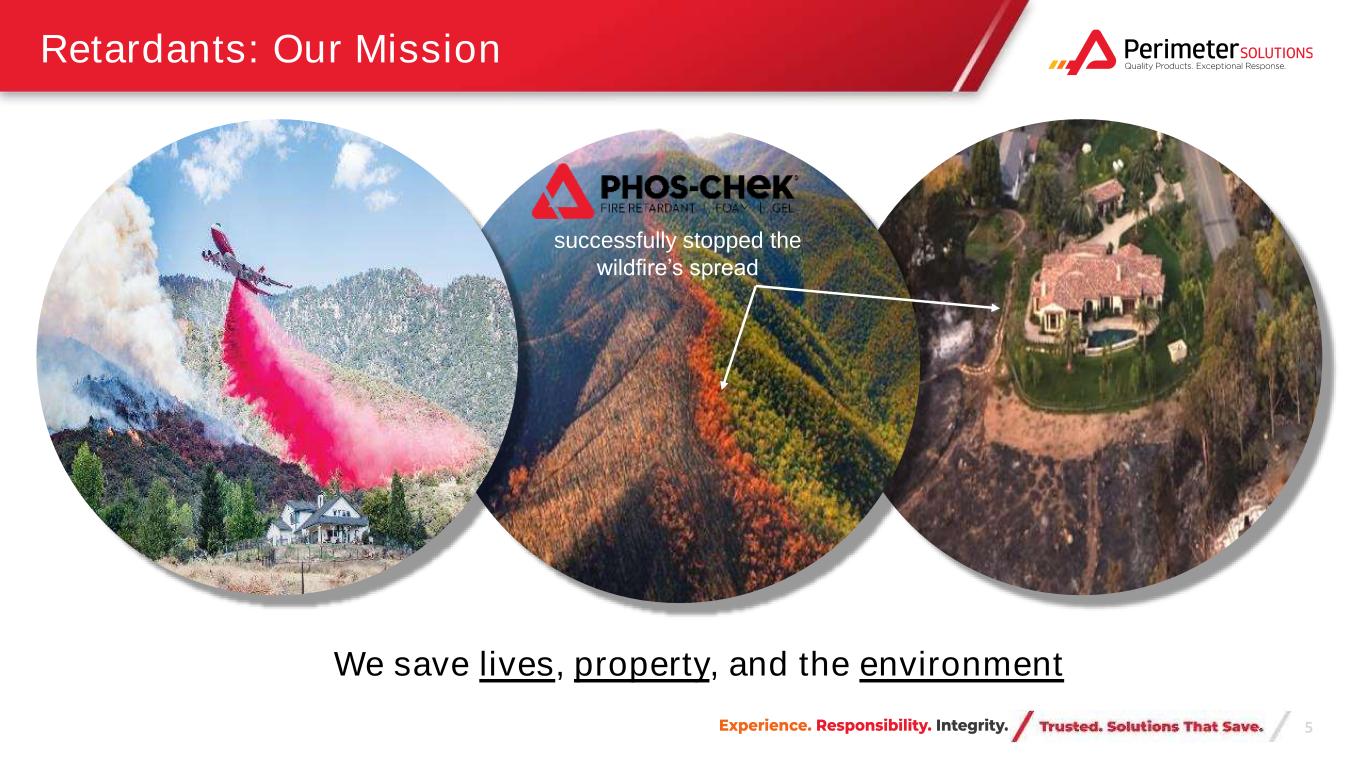

5 Retardants: Our Mission We save lives, property, and the environment successfully stopped the wildfire’s spread

6 Retardants: Extreme Criticality Fulfilling the mission requires 100% reliability, 100% of the time Deployed globally, including:

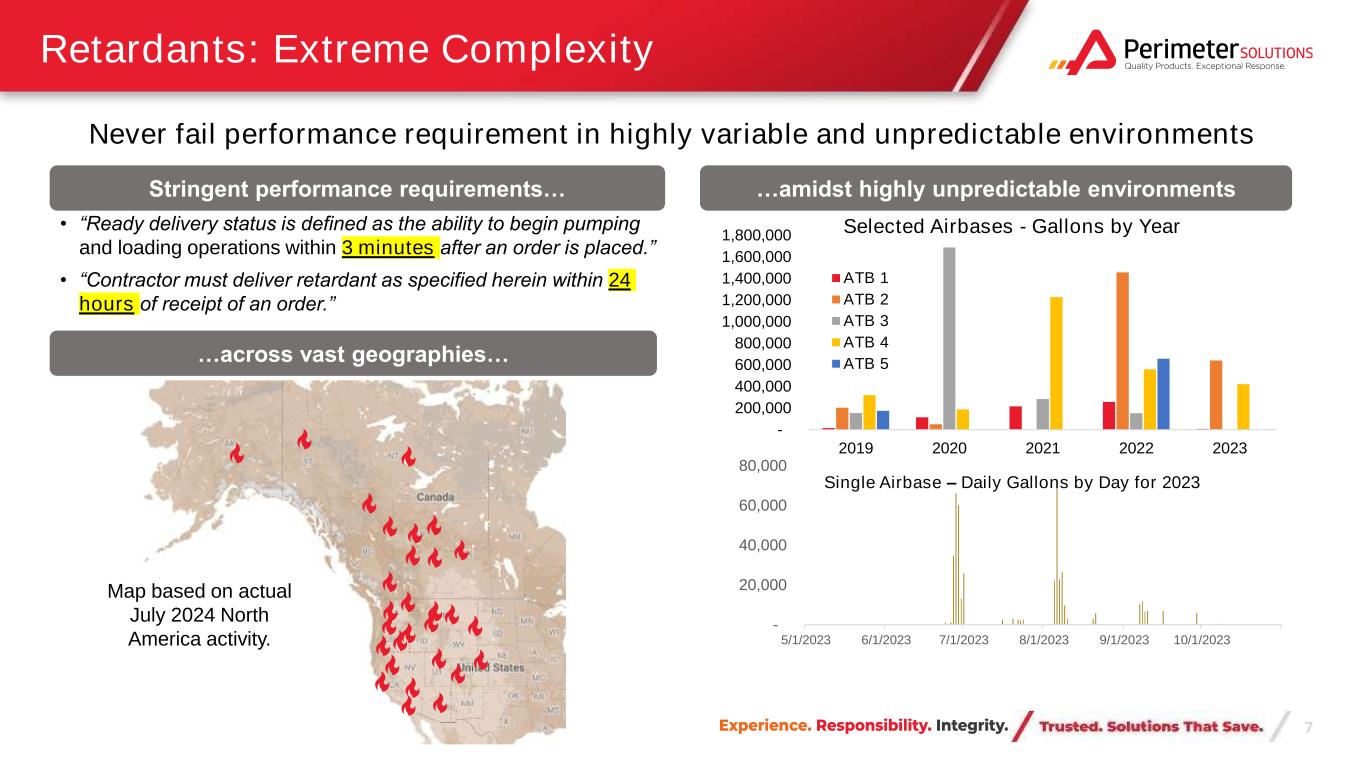

7 Retardants: Extreme Complexity • “Ready delivery status is defined as the ability to begin pumping and loading operations within 3 minutes after an order is placed.” • “Contractor must deliver retardant as specified herein within 24 hours of receipt of an order.” Never fail performance requirement in highly variable and unpredictable environments - 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 1,800,000 2019 2020 2021 2022 2023 Selected Airbases - Gallons by Year ATB 1 ATB 2 ATB 3 ATB 4 ATB 5 Stringent performance requirements… …amidst highly unpredictable environments - 20,000 40,000 60,000 80,000 5/1/2023 6/1/2023 7/1/2023 8/1/2023 9/1/2023 10/1/2023 Single Airbase – Daily Gallons by Day for 2023 Map based on actual July 2024 North America activity. …across vast geographies…

8 Integrated Solution To Complex Challenge Manufacturing & Distribution Inventory Comprehensive Airbase Footprint Base Infrastructure Research & Development Mobile Infrastructure Extreme Criticality Extreme Complexity Only our comprehensive, fully integrated-solution, built over 60 years, can fulfill our customers’ mission

9 What It Takes: R&D Industry approvals require multi-year internal-development programs, followed by multi-year customer testing protocols in the lab and field, prior to qualification After obtaining a Qualified Product Listing and then passing an Operational Field Evaluation, a retardant product is just arriving at the starting line

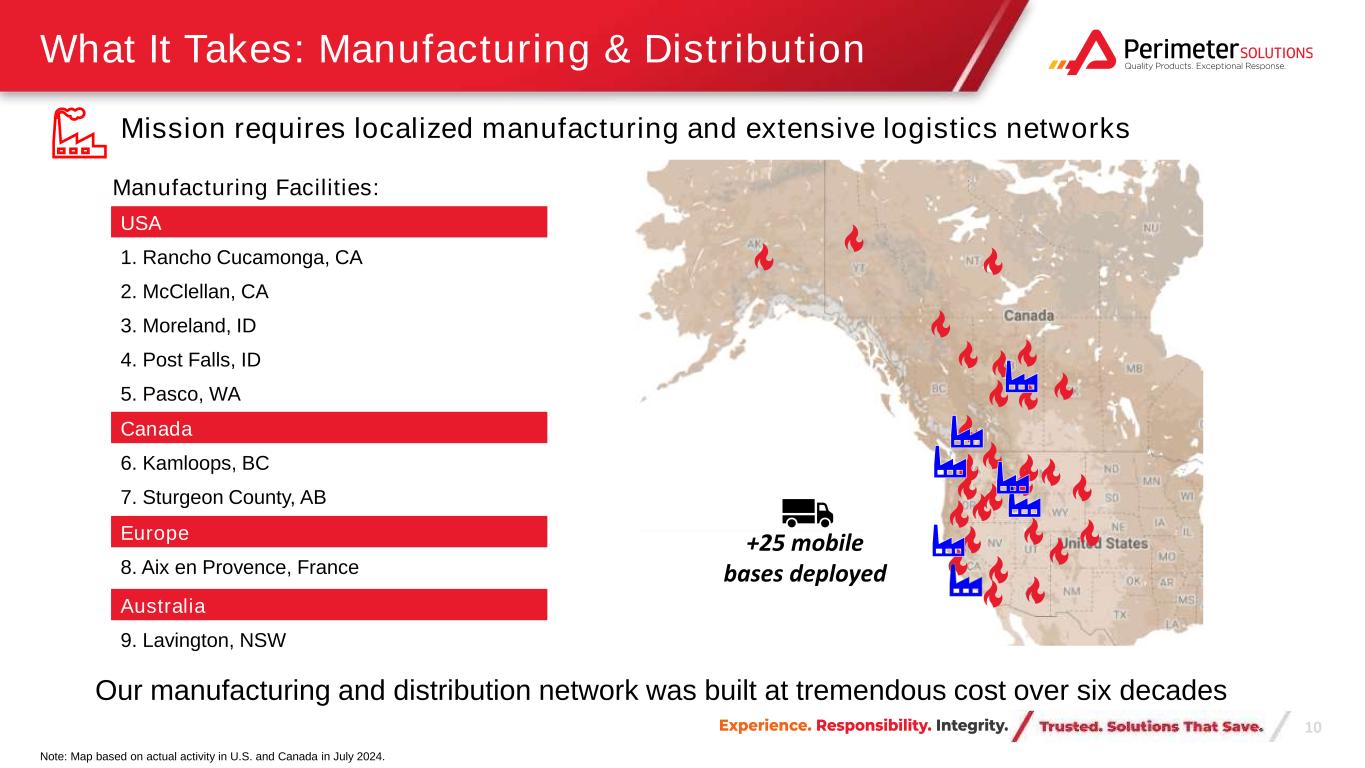

10 What It Takes: Manufacturing & Distribution USA 1. Rancho Cucamonga, CA 2. McClellan, CA 3. Moreland, ID 4. Post Falls, ID 5. Pasco, WA Canada 6. Kamloops, BC 7. Sturgeon County, AB Europe 8. Aix en Provence, France Australia 9. Lavington, NSW Manufacturing Facilities: Mission requires localized manufacturing and extensive logistics networks Note: Map based on actual activity in U.S. and Canada in July 2024. Our manufacturing and distribution network was built at tremendous cost over six decades +25 mobile bases deployed

11 What It Takes: Inventory We enter each fire season prepared for volatility – including record seasons Note: $143M is the three-year average of total company inventory on 6/30 of each year; US Acres Burned 2024 is YTD through Aug 28 $143M average annual investment in inventory -8,000,000 -6,000,000 -4,000,000 -2,000,000 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 2 0 2 3 2 0 2 4 Y T D US Acres Burned Ex-AK, YOY Absolute Change

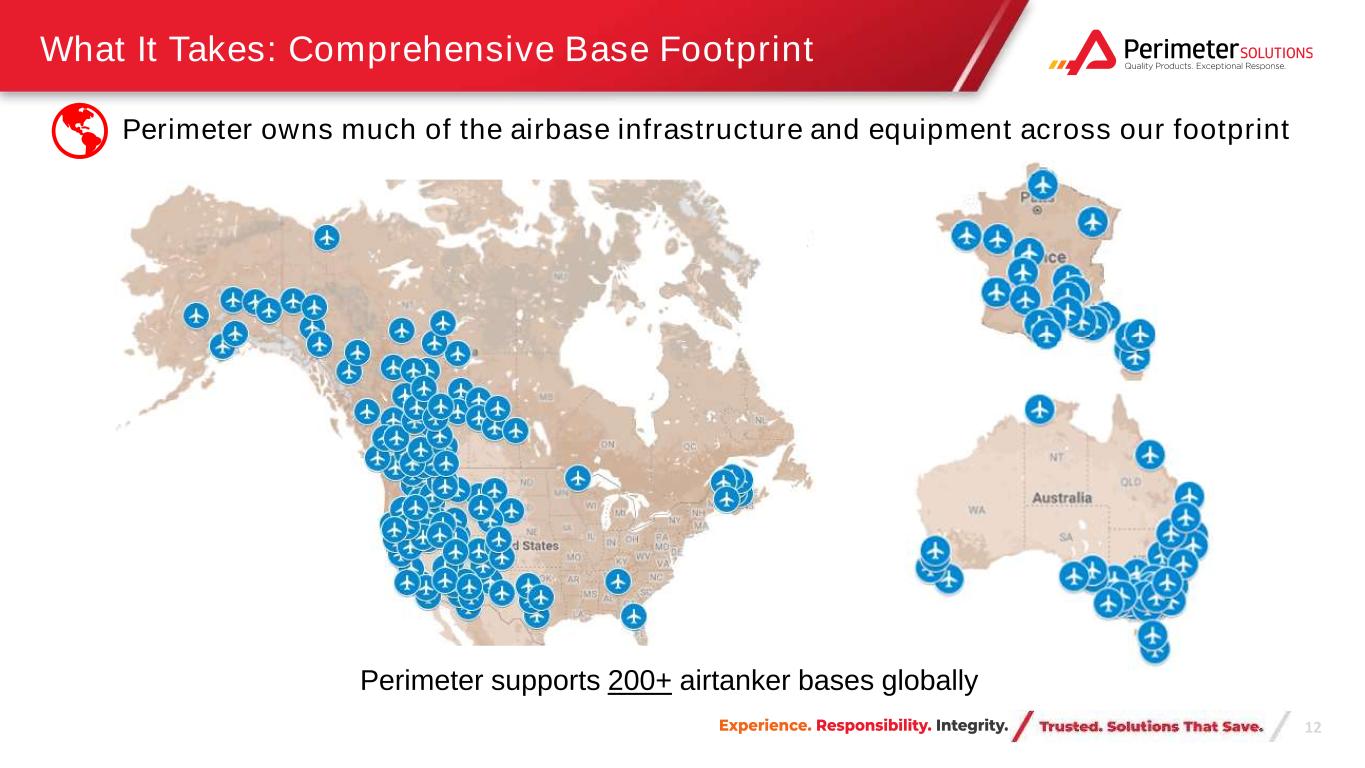

12 What It Takes: Comprehensive Base Footprint Perimeter owns much of the airbase infrastructure and equipment across our footprint Perimeter supports 200+ airtanker bases globally

13 What It Takes: End-to-End Airbase Infrastructure Perimeter handles airbase operations from end-to-end: design, construction, equipment ownership, maintenance, inventory, and staffing A single airbase can cost over $3M to fully develop Note: capital expenditures plus pre-opening expenses SolidWorks 3D modeling

14 What It Takes: Extensive Mobile Infrastructure Our global fleet of mobile bases allows us set-up in the most remote of locations in a matter of hours to support our customers with 100% reliability 100% of the time A mobile base costs up to $2.0M; can deploy to 35 different sites simultaneously Note: costs are replacement costs for new equipment

15 What It Takes: Perimeter Solutions Nothing short of Perimeter’s comprehensive offering fulfills the mission: Save Lives, Protect Property, 100% Reliability To build Perimeter today would take enormous investment over many years Manufacturing & Distribution Inventory Comprehensive Airbase Footprint Base Infrastructure Research & Development Mobile Infrastructure

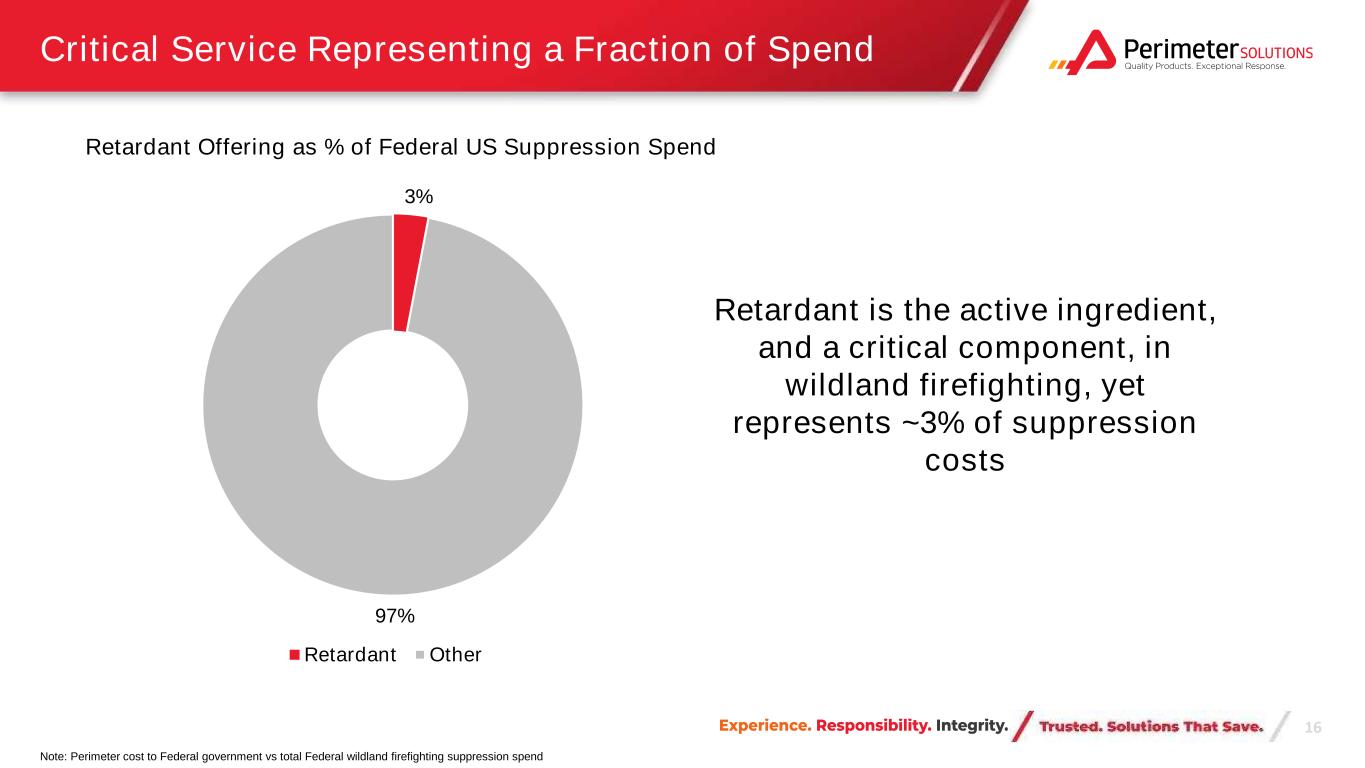

16 Critical Service Representing a Fraction of Spend 3% 97% Retardant Offering as % of Federal US Suppression Spend Retardant Other Retardant is the active ingredient, and a critical component, in wildland firefighting, yet represents ~3% of suppression costs Note: Perimeter cost to Federal government vs total Federal wildland firefighting suppression spend

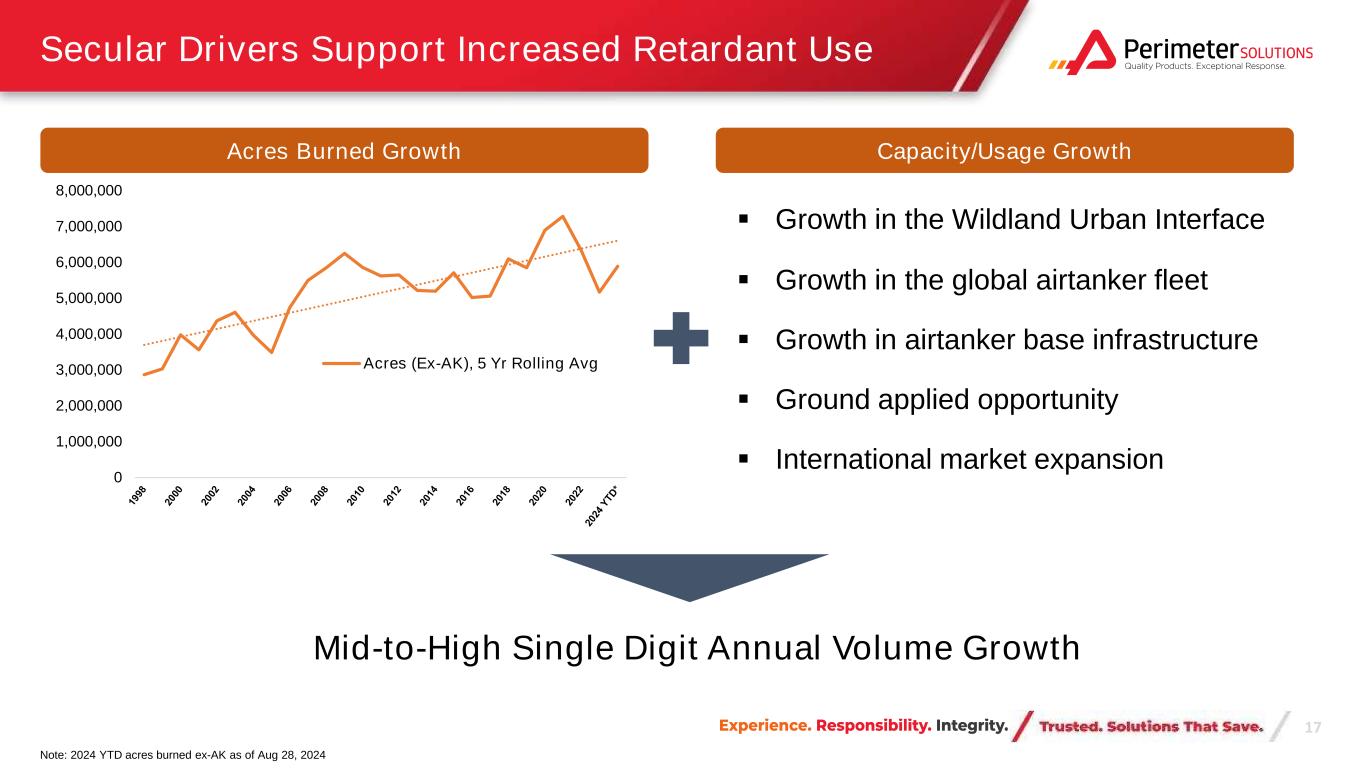

17 Secular Drivers Support Increased Retardant Use Capacity/Usage GrowthAcres Burned Growth ▪ Growth in the Wildland Urban Interface ▪ Growth in the global airtanker fleet ▪ Growth in airtanker base infrastructure ▪ Ground applied opportunity ▪ International market expansion 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 Acres (Ex-AK), 5 Yr Rolling Avg Mid-to-High Single Digit Annual Volume Growth Note: 2024 YTD acres burned ex-AK as of Aug 28, 2024

18 Global Market Presence PRM Plant • Market leader in fluorine-free foams and associated systems quickly becoming industry standard • Perimeter operates globally, with facilities in the US, Europe, the Middle East, and Australia Integrated Product, Equipment, & Service Offering R&D Manufacturing Service Emergency Response • Assist customers with product selection, equipment installation, and training • Emergency response demand requires never fail, global service network • Best-in-class R&D team develops market leading fluorine free products Suppressants Overview Perimeter is the market leader in the fluorine free foams, which are rapidly becoming the industry standard • Manufacturing in the US, EU, the Middle East, and Australia Market performance requires a comprehensive and integrated offering spanning product (foam), equipment (installed hardware), and service (emergency response foam replenishment)

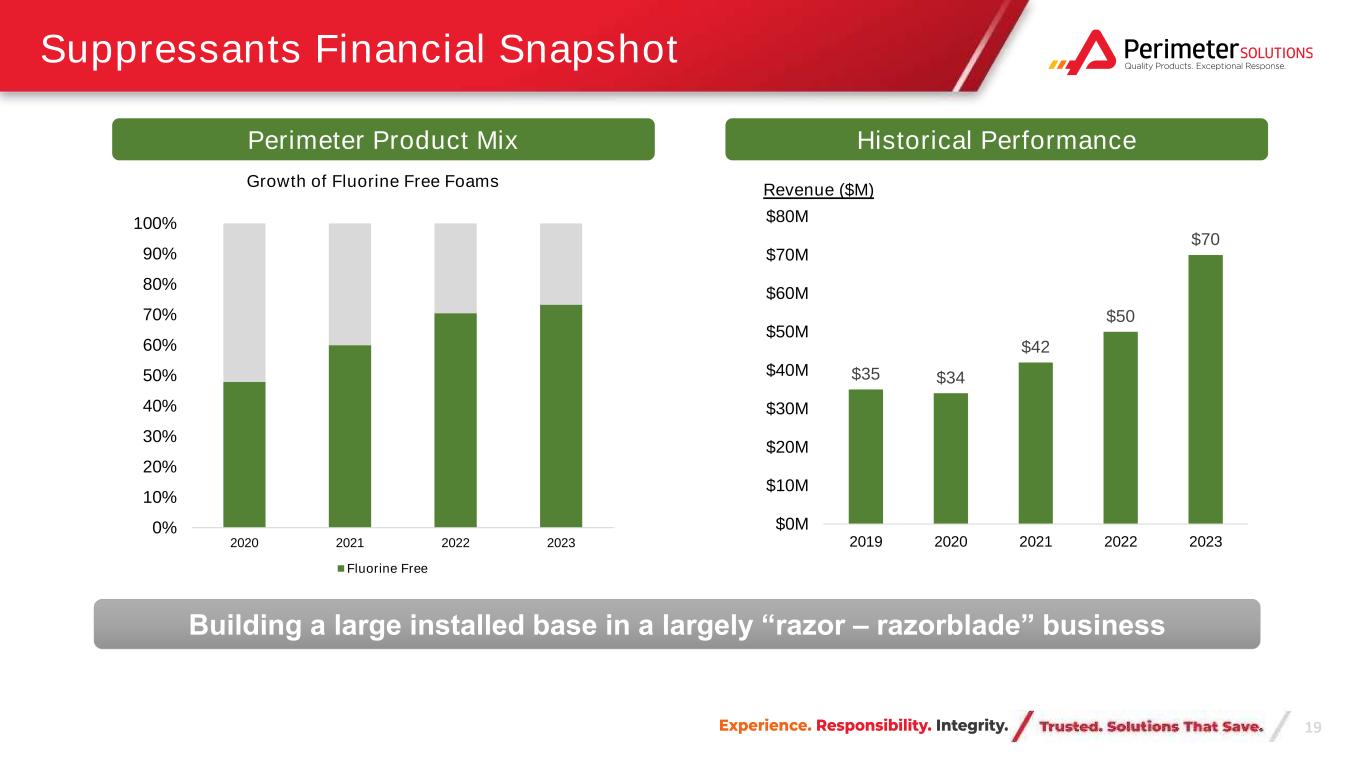

19 Suppressants Financial Snapshot $35 $34 $42 $50 $70 $0M $10M $20M $30M $40M $50M $60M $70M $80M 2019 2020 2021 2022 2023 Revenue ($M) Perimeter Product Mix Building a large installed base in a largely “razor – razorblade” business 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2020 2021 2022 2023 Growth of Fluorine Free Foams Fluorine Free Historical Performance

20 Localized Markets w/ Limited Competition PRM Plant Competitor 1 Competitor 2 • Perimeter operates predominately in OECD markets • One main competitor in each of the US and the EU • Perimeter owns >50% of installed OECD capacity • New build cost > $250M, permitting new plants highly unlikely, no new OECD P2S5 capacity in >50 years Integrated Product, Equipment, & Service Offering R&D Sourcing Manufacturing Delivery • 70 years experience navigating highly regulated global supply & delivery logistics • Proprietary, patented delivery system w/ superior safety & functionality • Collaborate closely with our customers to develop new P2S5 based applications Specialty Products Overview Perimeter is the leader in a highly specialized niche market • Manufacturing in the US and Europe Stringent customer and regulatory standards require a comprehensive and integrated offering spanning product (P2S5), equipment (proprietary delivery system), and service (product handling and logistics)

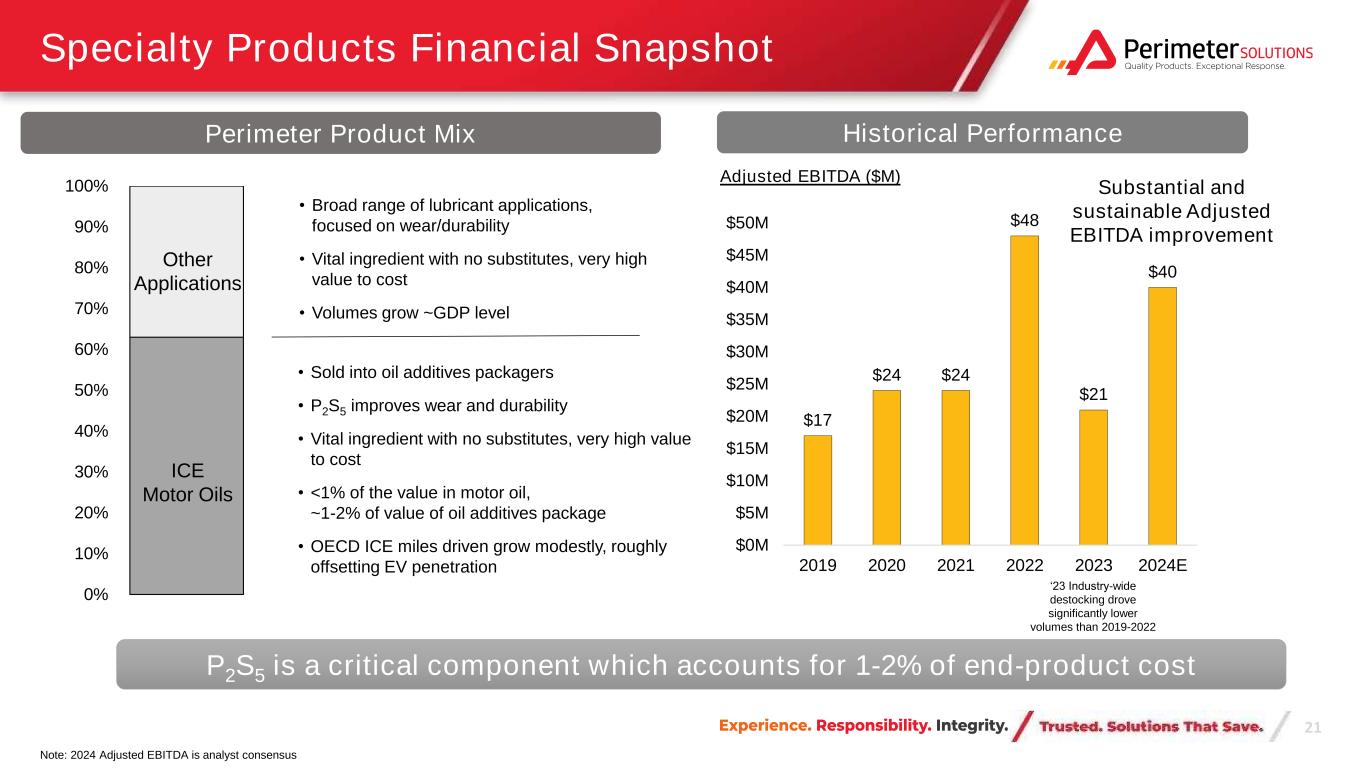

21 $17 $24 $24 $48 $21 $40 $0M $5M $10M $15M $20M $25M $30M $35M $40M $45M $50M 2019 2020 2021 2022 2023 2024E Specialty Products Financial Snapshot Substantial and sustainable Adjusted EBITDA improvement 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% ICE Motor Oils Other Applications • Broad range of lubricant applications, focused on wear/durability • Vital ingredient with no substitutes, very high value to cost • Volumes grow ~GDP level • Sold into oil additives packagers • P2S5 improves wear and durability • Vital ingredient with no substitutes, very high value to cost • <1% of the value in motor oil, ~1-2% of value of oil additives package • OECD ICE miles driven grow modestly, roughly offsetting EV penetration Adjusted EBITDA ($M) Perimeter Product Mix ‘23 Industry-wide destocking drove significantly lower volumes than 2019-2022 P2S5 is a critical component which accounts for 1-2% of end-product cost Historical Performance Note: 2024 Adjusted EBITDA is analyst consensus

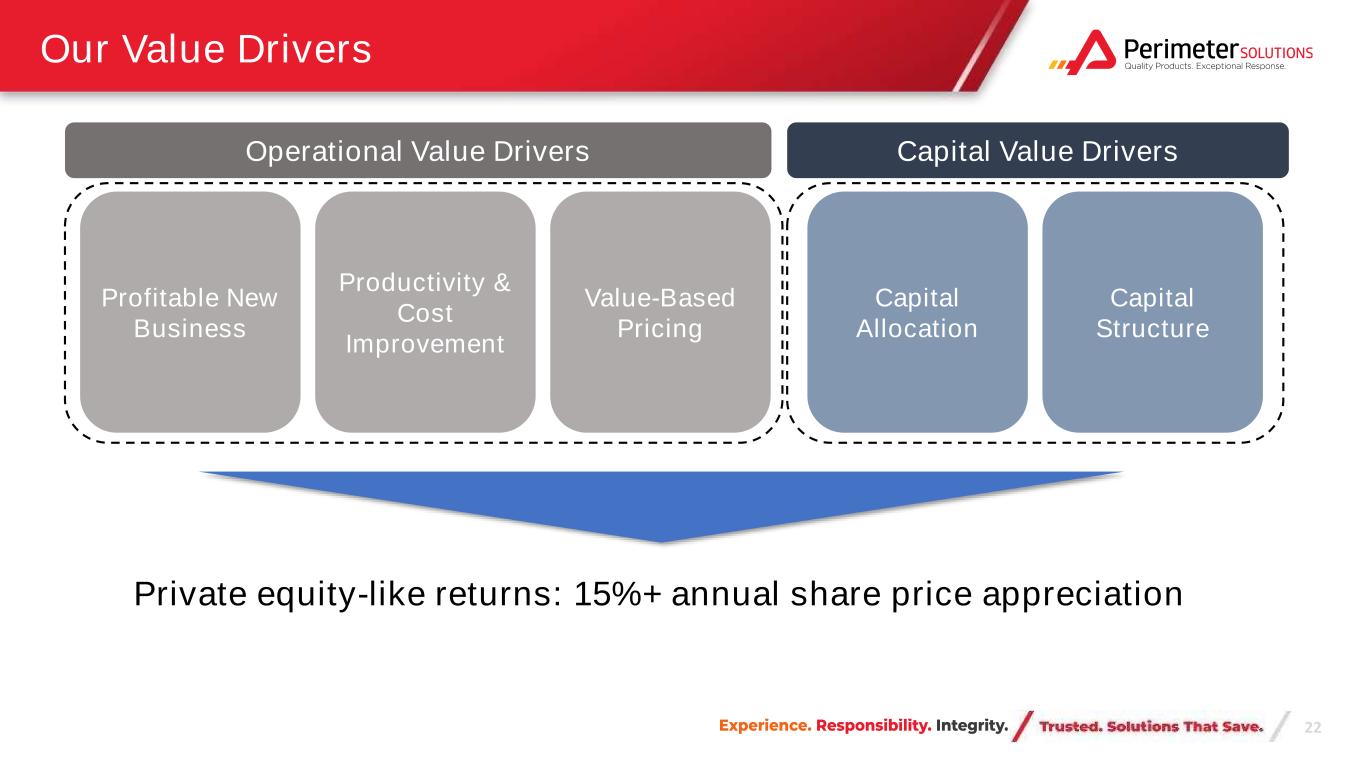

22 Our Value Drivers Profitable New Business Productivity & Cost Improvement Value-Based Pricing Capital Allocation Capital Structure Operational Value Drivers Capital Value Drivers Private equity-like returns: 15%+ annual share price appreciation

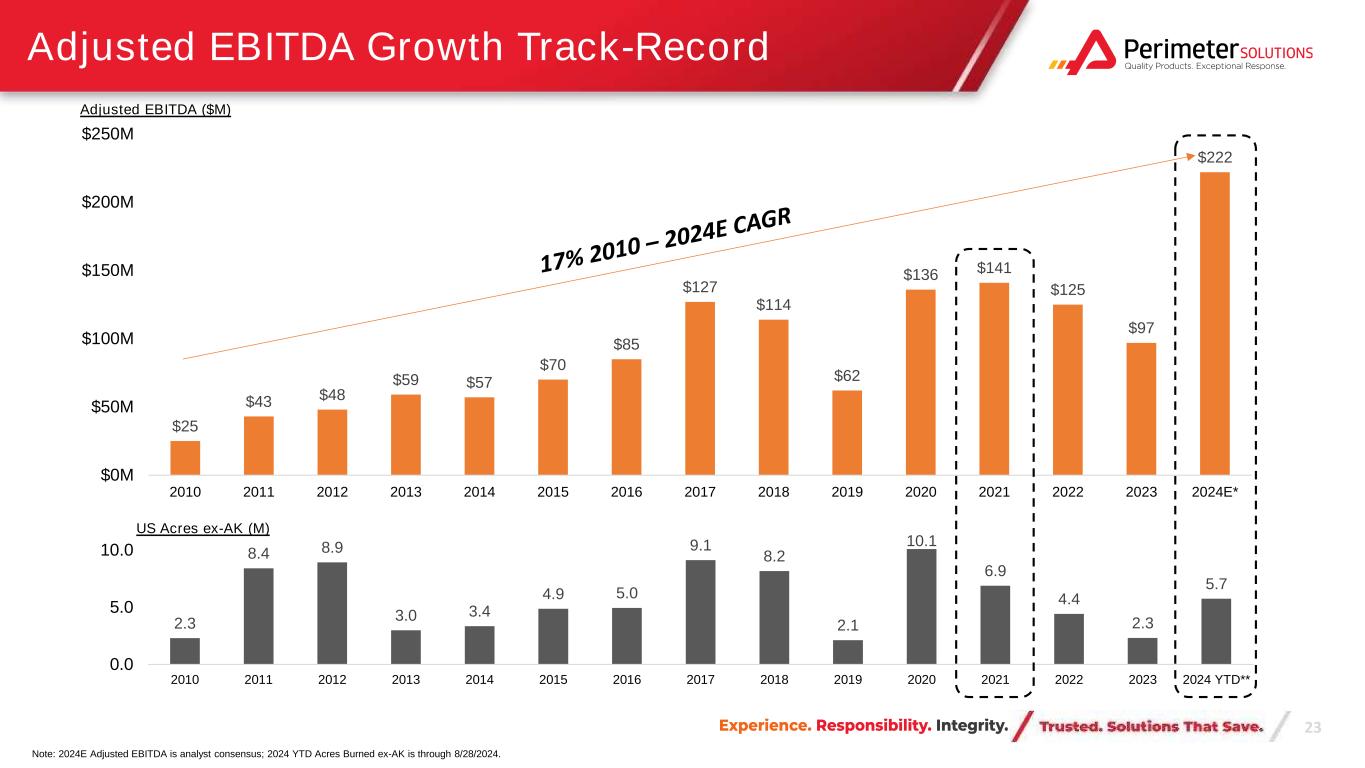

23 Adjusted EBITDA Growth Track-Record $25 $43 $48 $59 $57 $70 $85 $127 $114 $62 $136 $141 $125 $97 $222 $0M $50M $100M $150M $200M $250M 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024E* Adjusted EBITDA ($M) 2.3 8.4 8.9 3.0 3.4 4.9 5.0 9.1 8.2 2.1 10.1 6.9 4.4 2.3 5.7 0.0 5.0 10.0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 YTD** US Acres ex-AK (M) Note: 2024E Adjusted EBITDA is analyst consensus; 2024 YTD Acres Burned ex-AK is through 8/28/2024.

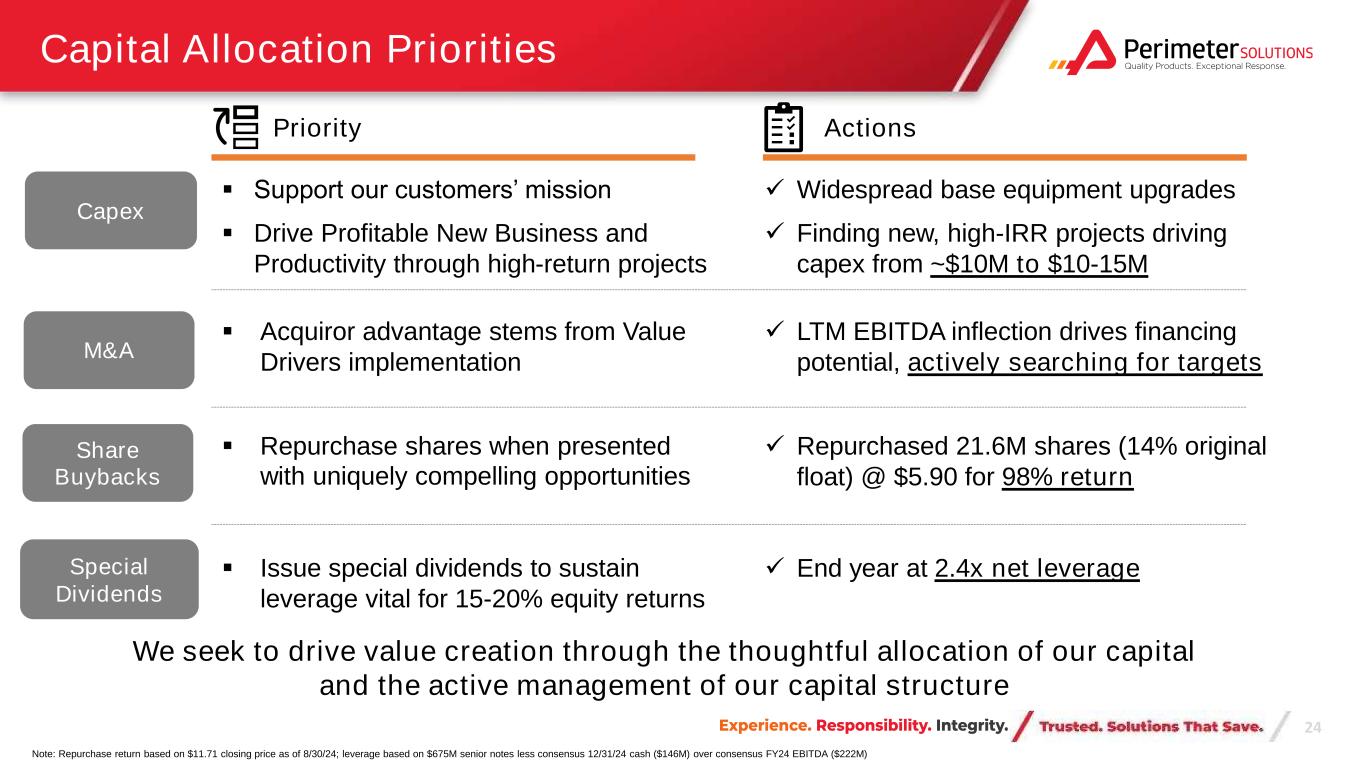

24 Capital Allocation Priorities ▪ Issue special dividends to sustain leverage vital for 15-20% equity returns ▪ Support our customers’ mission ▪ Drive Profitable New Business and Productivity through high-return projects ▪ Acquiror advantage stems from Value Drivers implementation ▪ Repurchase shares when presented with uniquely compelling opportunities We seek to drive value creation through the thoughtful allocation of our capital and the active management of our capital structure Capex M&A Share Buybacks Special Dividends ✓ Widespread base equipment upgrades ✓ Finding new, high-IRR projects driving capex from ~$10M to $10-15M ✓ LTM EBITDA inflection drives financing potential, actively searching for targets ✓ Repurchased 21.6M shares (14% original float) @ $5.90 for 98% return Priority Actions ✓ End year at 2.4x net leverage Note: Repurchase return based on $11.71 closing price as of 8/30/24; leverage based on $675M senior notes less consensus 12/31/24 cash ($146M) over consensus FY24 EBITDA ($222M)

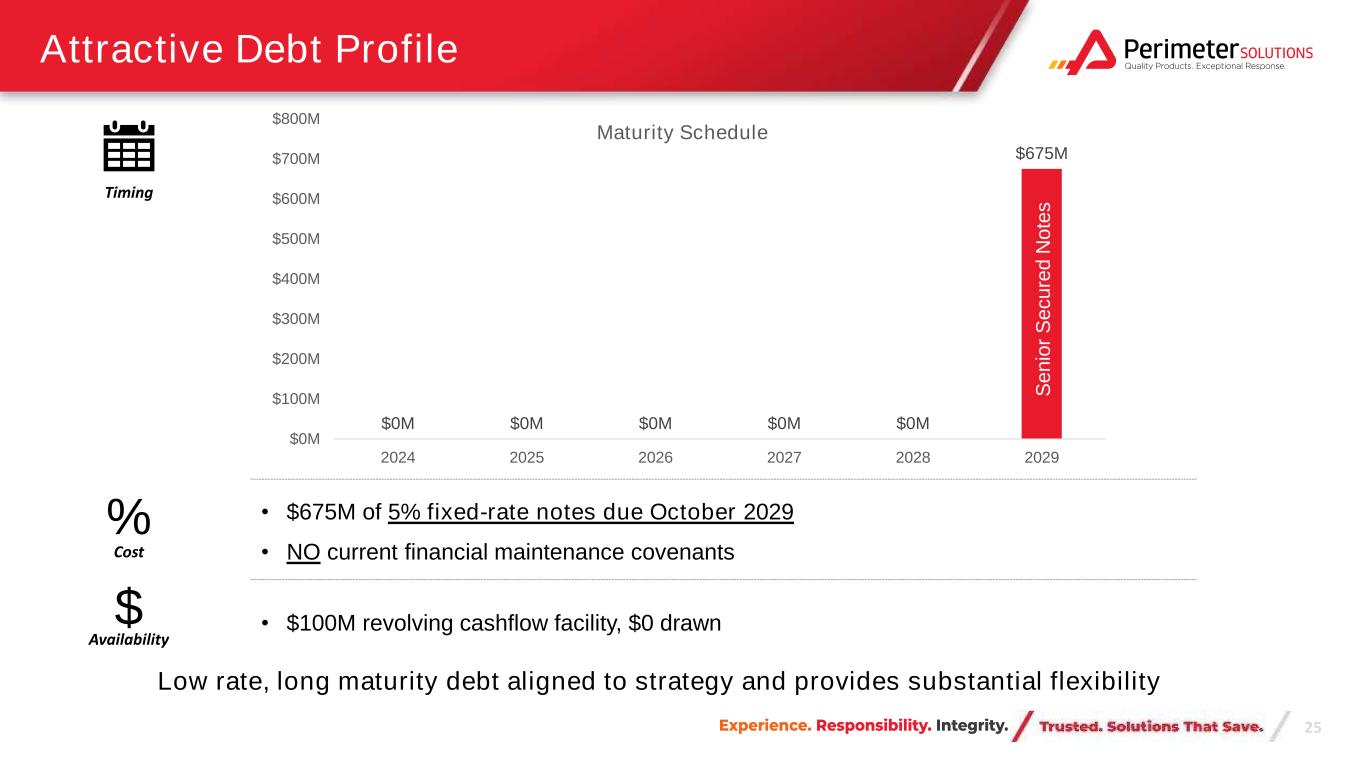

25 Attractive Debt Profile • $675M of 5% fixed-rate notes due October 2029 • NO current financial maintenance covenants $0M $0M $0M $0M $0M $675M $0M $100M $200M $300M $400M $500M $600M $700M $800M 2024 2025 2026 2027 2028 2029 Maturity Schedule S e n io r S e c u re d N o te s % Timing Cost $ Availability • $100M revolving cashflow facility, $0 drawn Low rate, long maturity debt aligned to strategy and provides substantial flexibility

26 Three Key Messages Attractive Businesses Value Creation Strategy Our Goal Retardants/Suppressants/ Specialty Products ▪ Market Leadership Positions ▪ Challenging Markets to Serve o Critical Products Serving Demanding End-Markets o Complex Chemistries o Tightly Integrated Product / Equipment / Service Offerings ▪ Attractive Growth Profiles Deliver private-equity like returns with the liquidity of a public market Operational Value Drivers ~70%* Adjusted EBITDA uplift in three years Capital Allocation and Capital Structure Repurchased 21.6M shares at $5.90/share

Thank You! NOTICE: Although the information and recommendations set forth herein (hereinafter “Information”) are presented in good faith and believed to be correct as of the date hereof, Perimeter Solutions/Solberg/Auxquimia (the “Company”) makes no representations or warranties as to the completeness or accuracy thereof. Information is supplied upon the condition that the persons receiving same will make their own determination as to its suitability for their purposes prior to use. In no event will the Company be responsible for damages of any nature whatsoever resulting from the use or reliance upon Information or the product to which Information refers. Nothing contained herein is to be construed as a recommendation to use any product, process, equipment or formulation in conflict with any patent, and the Company makes no representation or warranty, express or implied, that the use thereof will not infringe any patent. NO REPRESENTATIONS OR WARRANTIES, EITHER EXPRESSED OR IMPLIED, OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE OR OF ANY OTHER NATURE ARE MADE HEREUNDER WITH RESPECT TO INFORMATION OR THE PRODUCT TO WHICH INFORMATION REFERS.

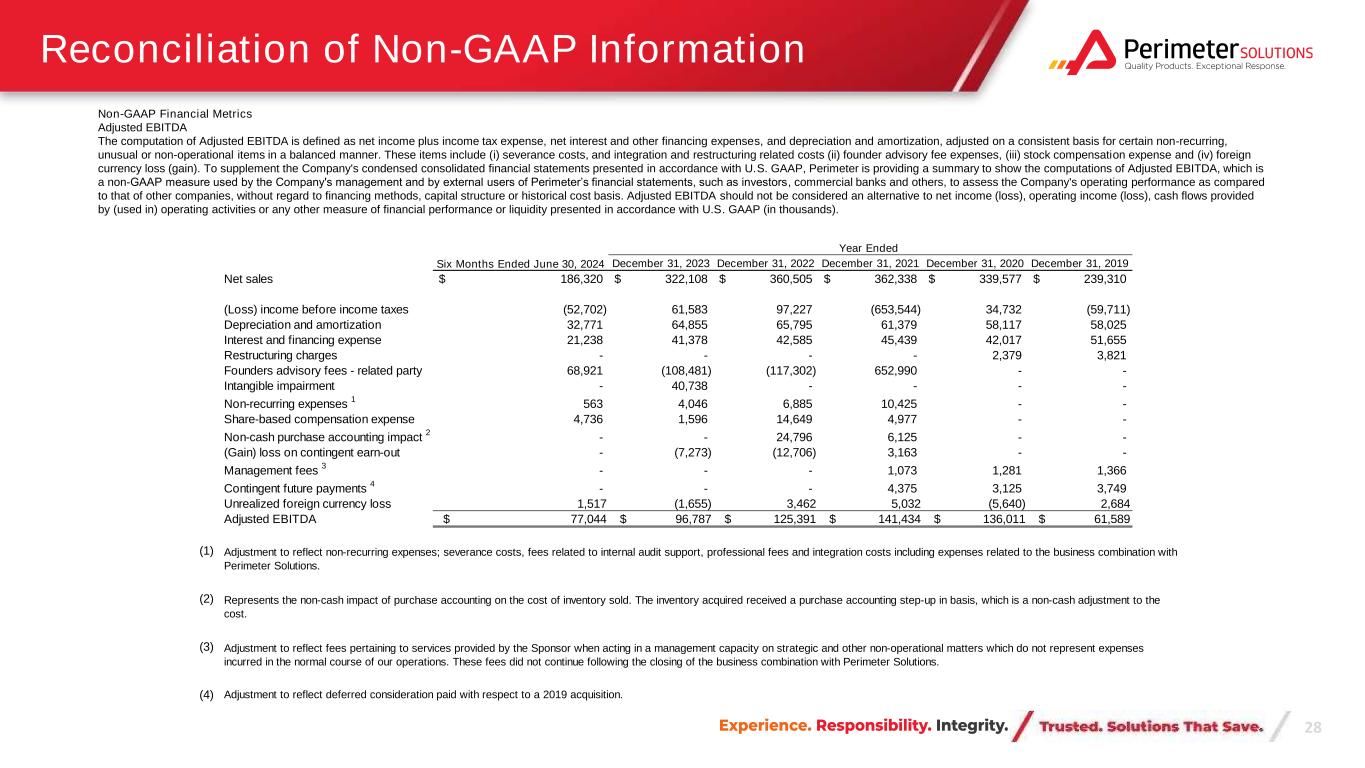

28 Reconciliation of Non-GAAP Information Non-GAAP Financial Metrics Adjusted EBITDA The computation of Adjusted EBITDA is defined as net income plus income tax expense, net interest and other financing expenses, and depreciation and amortization, adjusted on a consistent basis for certain non-recurring, unusual or non-operational items in a balanced manner. These items include (i) severance costs, and integration and restructuring related costs (ii) founder advisory fee expenses, (iii) stock compensation expense and (iv) foreign currency loss (gain). To supplement the Company's condensed consolidated financial statements presented in accordance with U.S. GAAP, Perimeter is providing a summary to show the computations of Adjusted EBITDA, which is a non-GAAP measure used by the Company's management and by external users of Perimeter’s financial statements, such as investors, commercial banks and others, to assess the Company's operating performance as compared to that of other companies, without regard to financing methods, capital structure or historical cost basis. Adjusted EBITDA should not be considered an alternative to net income (loss), operating income (loss), cash flows provided by (used in) operating activities or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP (in thousands). December 31, 2023 December 31, 2022 December 31, 2021 December 31, 2020 December 31, 2019 Net sales 186,320$ 322,108$ 360,505$ 362,338$ 339,577$ 239,310$ (Loss) income before income taxes (52,702) 61,583 97,227 (653,544) 34,732 (59,711) Depreciation and amortization 32,771 64,855 65,795 61,379 58,117 58,025 Interest and financing expense 21,238 41,378 42,585 45,439 42,017 51,655 Restructuring charges - - - - 2,379 3,821 Founders advisory fees - related party 68,921 (108,481) (117,302) 652,990 - - Intangible impairment - 40,738 - - - - Non-recurring expenses 1 563 4,046 6,885 10,425 - - Share-based compensation expense 4,736 1,596 14,649 4,977 - - Non-cash purchase accounting impact 2 - - 24,796 6,125 - - (Gain) loss on contingent earn-out - (7,273) (12,706) 3,163 - - Management fees 3 - - - 1,073 1,281 1,366 Contingent future payments 4 - - - 4,375 3,125 3,749 Unrealized foreign currency loss 1,517 (1,655) 3,462 5,032 (5,640) 2,684 Adjusted EBITDA $ 77,044 $ 96,787 $ 125,391 $ 141,434 $ 136,011 $ 61,589 (1) (2) (3) (4) Adjustment to reflect deferred consideration paid with respect to a 2019 acquisition. Year Ended Six Months Ended June 30, 2024 Adjustment to reflect non-recurring expenses; severance costs, fees related to internal audit support, professional fees and integration costs including expenses related to the business combination with Perimeter Solutions. Represents the non-cash impact of purchase accounting on the cost of inventory sold. The inventory acquired received a purchase accounting step-up in basis, which is a non-cash adjustment to the cost. Adjustment to reflect fees pertaining to services provided by the Sponsor when acting in a management capacity on strategic and other non-operational matters which do not represent expenses incurred in the normal course of our operations. These fees did not continue following the closing of the business combination with Perimeter Solutions.