EX-99.2

Published on December 10, 2025

Perimeter Solutions MMT Acquisition Call December 11, 2025

2 Certain statements in this presentation and discussion are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are based on Perimeter Solutions, Inc.’s (the “Company”) expectations, intentions and projections regarding the Company’s future performance, anticipated events or trends and other matters that are not historical facts. Words such as “anticipate,” “estimate,” “seek,” “expect,” “forecast,” “project,” “plan,” “intend,” “believe,” “may,” “should,” or similar expressions are intended to identify these forward- looking statements. These forward-looking statements include, but are not limited to, statements regarding (i) estimates, beliefs and forecasts of our financial, operational and performance metrics, including, but not limited to, Adjusted EBITDA and Adjusted EBITDA Margin; (ii) our expectations regarding MMT’s financial performance, including, but not limited to, its revenue and Adjusted EBITDA; (iii) our expectations regarding the timing of consummation of the MMT transaction; (iv) the expected financing of the MMT transaction; (v) MMT’s demand drivers; (vi) the opportunity to expand our business through strategic acquisitions consistent with our operational pillars and the extent to which MMT fits within our operational pillars; and (vii) our expectations regarding MMT's average machine lifespan. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For further information, please refer to the Company’s reports and filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company does not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), we have included the following non-GAAP financial information in this presentation: adjusted EBITDA, adjusted EBITDA margin, last twelve months (“LTM”) adjusted EBITDA, and net debt to LTM adjusted EBITDA. The reconciliations of these non-GAAP measures to the most directly comparable financial measures calculated and presented in accordance with GAAP can be found in the Appendix to this presentation. Because these non-GAAP financial measures exclude certain items as described herein, they may not be indicative of the results that the Company expects to recognize for future periods. As a result, these non-GAAP financial measures should be considered in addition to, and not a substitute for, financial information prepared in accordance with GAAP. MMT Adjusted EBITDA is a non-GAAP measure, which reflects the Company's internal estimate based on the quality of earnings report ("QOE Report") received by the Company. MMT Adjusted EBITDA is defined as income (loss) before income taxes, plus net interest expense and other financing expenses, and depreciation and amortization, adjusted on a consistent basis for certain non-recurring, unusual or non-operational items. These items primarily include restructuring and integration costs, transaction expenses, and implementation and one-time consulting costs. MMT Adjusted EBITDA reflects the acquisitions consummated by MMT during the LTM period as if such acquisitions occurred as of October 1, 2024. Disclaimer

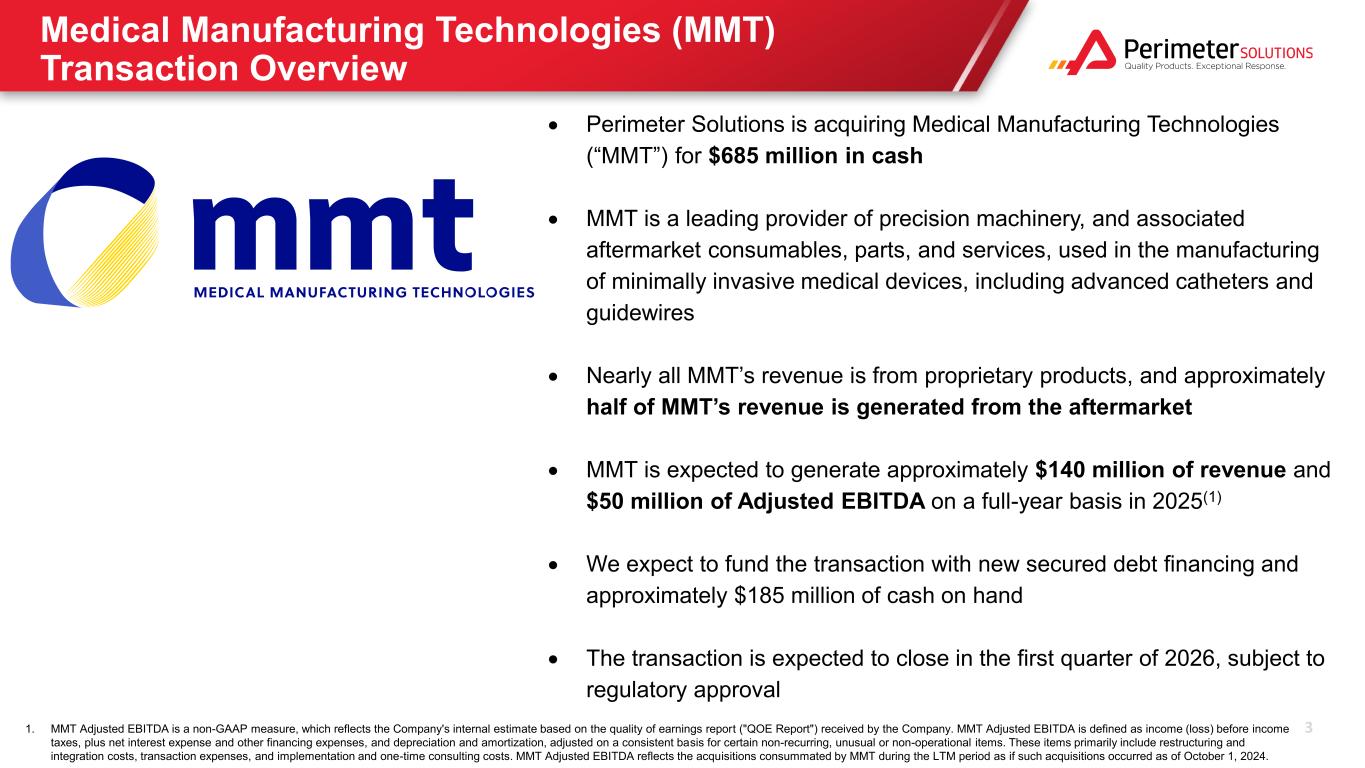

3 Medical Manufacturing Technologies (MMT) Transaction Overview • Perimeter Solutions is acquiring Medical Manufacturing Technologies (“MMT”) for $685 million in cash • MMT is a leading provider of precision machinery, and associated aftermarket consumables, parts, and services, used in the manufacturing of minimally invasive medical devices, including advanced catheters and guidewires • Nearly all MMT’s revenue is from proprietary products, and approximately half of MMT’s revenue is generated from the aftermarket • MMT is expected to generate approximately $140 million of revenue and $50 million of Adjusted EBITDA on a full-year basis in 2025(1) • We expect to fund the transaction with new secured debt financing and approximately $185 million of cash on hand • The transaction is expected to close in the first quarter of 2026, subject to regulatory approval 1. MMT Adjusted EBITDA is a non-GAAP measure, which reflects the Company's internal estimate based on the quality of earnings report ("QOE Report") received by the Company. MMT Adjusted EBITDA is defined as income (loss) before income taxes, plus net interest expense and other financing expenses, and depreciation and amortization, adjusted on a consistent basis for certain non-recurring, unusual or non-operational items. These items primarily include restructuring and integration costs, transaction expenses, and implementation and one-time consulting costs. MMT Adjusted EBITDA reflects the acquisitions consummated by MMT during the LTM period as if such acquisitions occurred as of October 1, 2024.

4 MMT’s Fit With Operational Pillars Exceptional Businesses Value Creation Strategy Our Purpose Broad Industrials Focus ▪ Mission Critical / Small Cost ▪ Challenging Problems ▪ Industry Leader ▪ Attractive Growth Operational Value Drivers ▪ Profitable New Business ▪ Productivity & Cost Improvement ▪ Value-based Pricing Capital Allocation & Structure Fulfill Mission Deliver private-equity like returns (15%+) Decentralization Operating Autonomy Budget Accountability Incentive Alignment

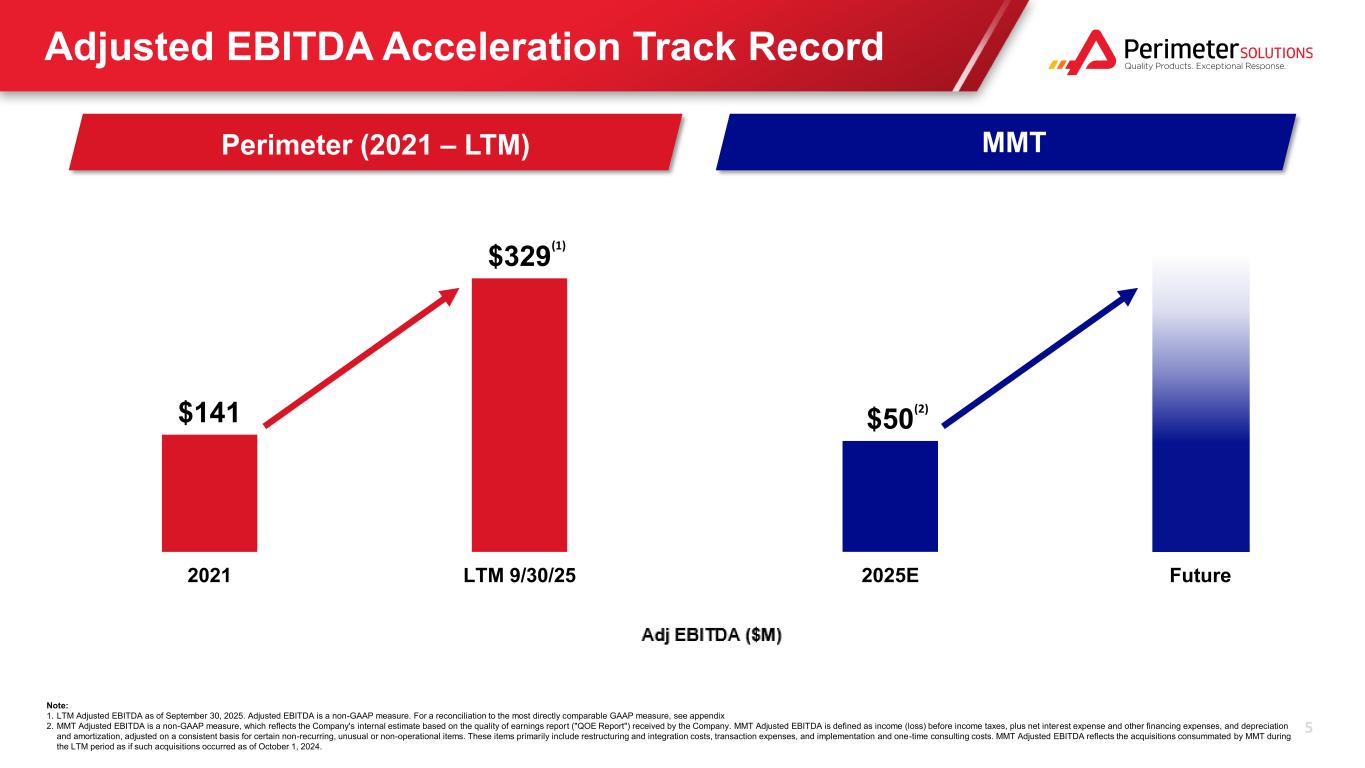

5 $50 2025E Future Adjusted EBITDA Acceleration Track Record Perimeter (2021 – LTM) MMT Note: 1. LTM Adjusted EBITDA as of September 30, 2025. Adjusted EBITDA is a non-GAAP measure. For a reconciliation to the most directly comparable GAAP measure, see appendix 2. MMT Adjusted EBITDA is a non-GAAP measure, which reflects the Company's internal estimate based on the quality of earnings report ("QOE Report") received by the Company. MMT Adjusted EBITDA is defined as income (loss) before income taxes, plus net interest expense and other financing expenses, and depreciation and amortization, adjusted on a consistent basis for certain non-recurring, unusual or non-operational items. These items primarily include restructuring and integration costs, transaction expenses, and implementation and one-time consulting costs. MMT Adjusted EBITDA reflects the acquisitions consummated by MMT during the LTM period as if such acquisitions occurred as of October 1, 2024. $141 $329 2021 LTM 9/30/25 (1) (2)

6 MMT’s Market and Customers What MMT Does Who MMT Serves • Long-standing relationships: top 10 customers have 15+ years average tenure • Deep relationships: 100% of top 10 customers purchase multiple solution types • Broad relationships: Top 10 customers purchase from MMT at an average of 15 sites MMT manufactures and supports equipment for manufacturing medical devices Blue-chip medical device OEMs Stent Crimping Catheter Tube Cutter Balloon Catheter Forming ECG Automated Cutoff Machine

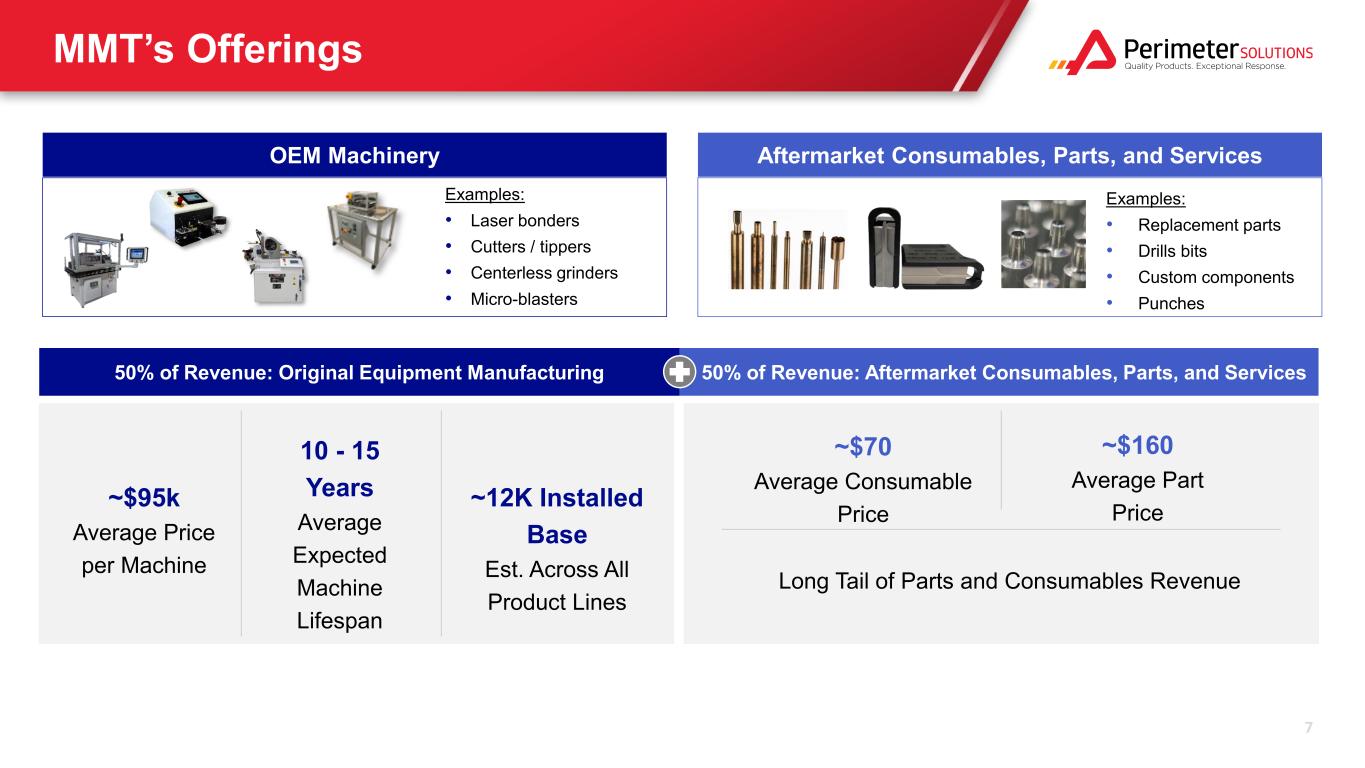

7 50% of Revenue: Aftermarket Consumables, Parts, and Services50% of Revenue: Original Equipment Manufacturing Long Tail of Parts and Consumables Revenue ~$70 Average Consumable Price ~$160 Average Part Price ~$95k Average Price per Machine 10 - 15 Years Average Expected Machine Lifespan ~12K Installed Base Est. Across All Product Lines Aftermarket Consumables, Parts, and ServicesOEM Machinery Examples: • Laser bonders • Cutters / tippers • Centerless grinders • Micro-blasters MMT’s Offerings Examples: • Replacement parts • Drills bits • Custom components • Punches

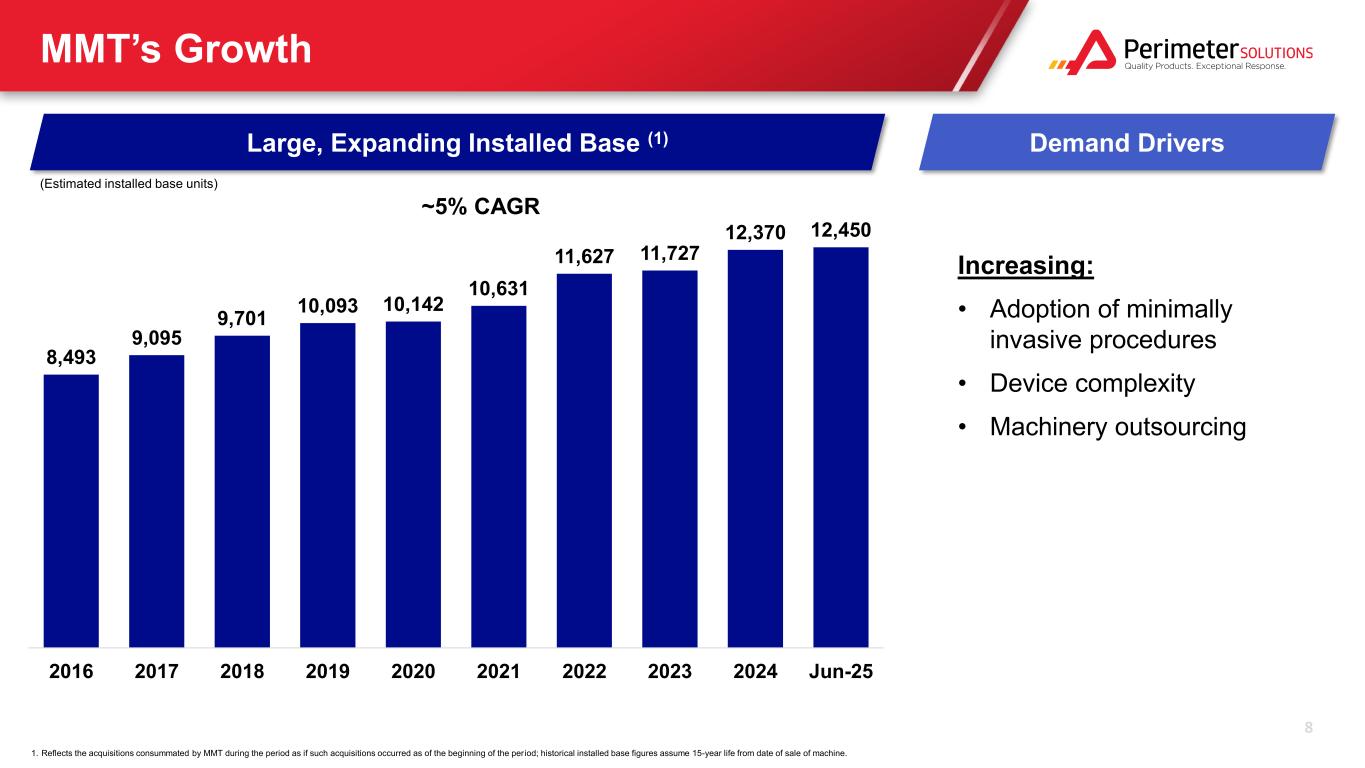

8 MMT’s Growth 8,493 9,095 9,701 10,093 10,142 10,631 11,627 11,727 12,370 12,450 2016 2017 2018 2019 2020 2021 2022 2023 2024 Jun-25 Large, Expanding Installed Base (1) (Estimated installed base units) ~5% CAGR 1. Reflects the acquisitions consummated by MMT during the period as if such acquisitions occurred as of the beginning of the period; historical installed base figures assume 15-year life from date of sale of machine. Demand Drivers Increasing: • Adoption of minimally invasive procedures • Device complexity • Machinery outsourcing

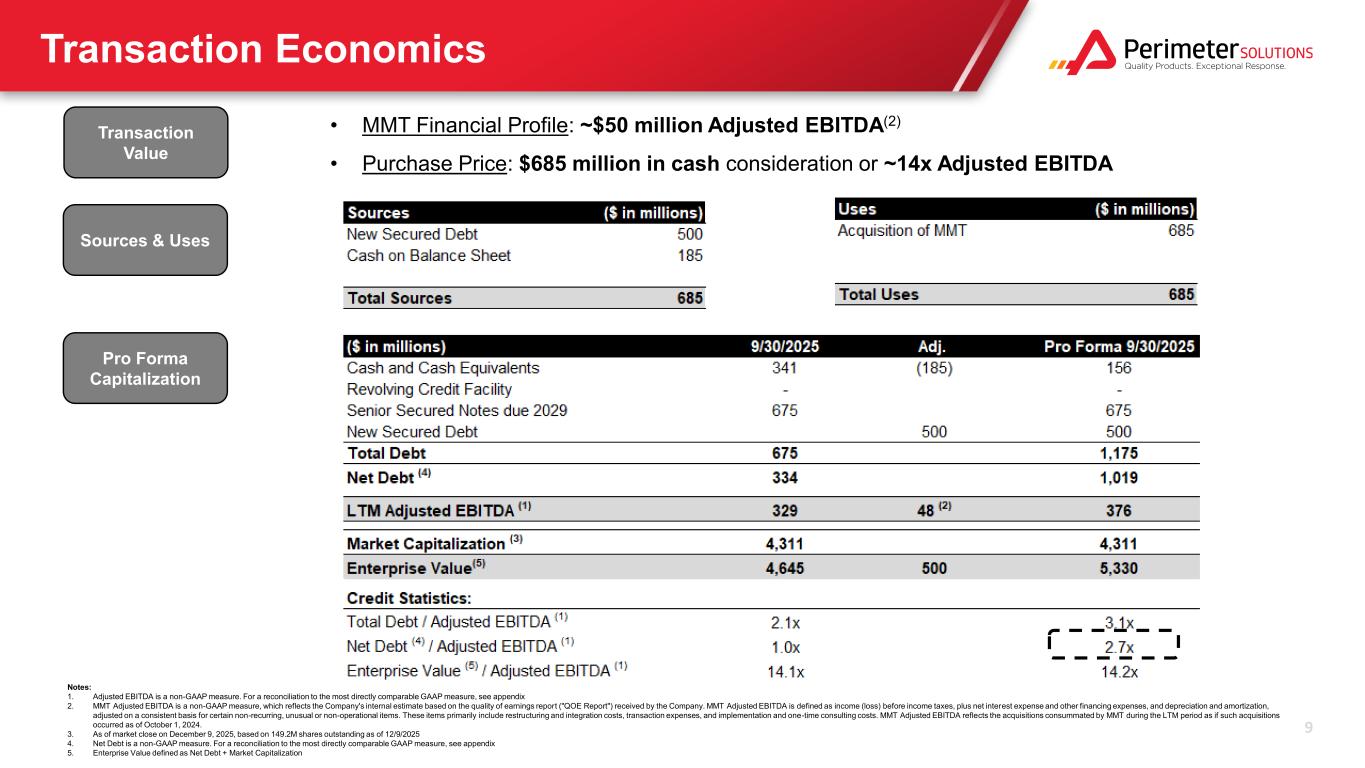

9 Transaction Economics Transaction Value Sources & Uses Pro Forma Capitalization • MMT Financial Profile: ~$50 million Adjusted EBITDA(2) • Purchase Price: $685 million in cash consideration or ~14x Adjusted EBITDA Notes: 1. Adjusted EBITDA is a non-GAAP measure. For a reconciliation to the most directly comparable GAAP measure, see appendix 2. MMT Adjusted EBITDA is a non-GAAP measure, which reflects the Company's internal estimate based on the quality of earnings report ("QOE Report") received by the Company. MMT Adjusted EBITDA is defined as income (loss) before income taxes, plus net interest expense and other financing expenses, and depreciation and amortization, adjusted on a consistent basis for certain non-recurring, unusual or non-operational items. These items primarily include restructuring and integration costs, transaction expenses, and implementation and one-time consulting costs. MMT Adjusted EBITDA reflects the acquisitions consummated by MMT during the LTM period as if such acquisitions occurred as of October 1, 2024. 3. As of market close on December 9, 2025, based on 149.2M shares outstanding as of 12/9/2025 4. Net Debt is a non-GAAP measure. For a reconciliation to the most directly comparable GAAP measure, see appendix 5. Enterprise Value defined as Net Debt + Market Capitalization

Thank You! NOTICE: Although the information and recommendations set forth herein (hereinafter “Information”) are presented in good faith and believed to be correct as of the date hereof, Perimeter Solutions/Solberg/Auxquimia (the “Company”) makes no representations or warranties as to the completeness or accuracy thereof. Information is supplied upon the condition that the persons receiving same will make their own determination as to its suitability for their purposes prior to use. In no event will the Company be responsible for damages of any nature whatsoever resulting from the use or reliance upon Information or the product to which Information refers. Nothing contained herein is to be construed as a recommendation to use any product, process, equipment or formulation in conflict with any patent, and the Company makes no representation or warranty, express or implied, that the use thereof will not infringe any patent. NO REPRESENTATIONS OR WARRANTIES, EITHER EXPRESSED OR IMPLIED, OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE OR OF ANY OTHER NATURE ARE MADE HEREUNDER WITH RESPECT TO INFORMATION OR THE PRODUCT TO WHICH INFORMATION REFERS.

Appendix

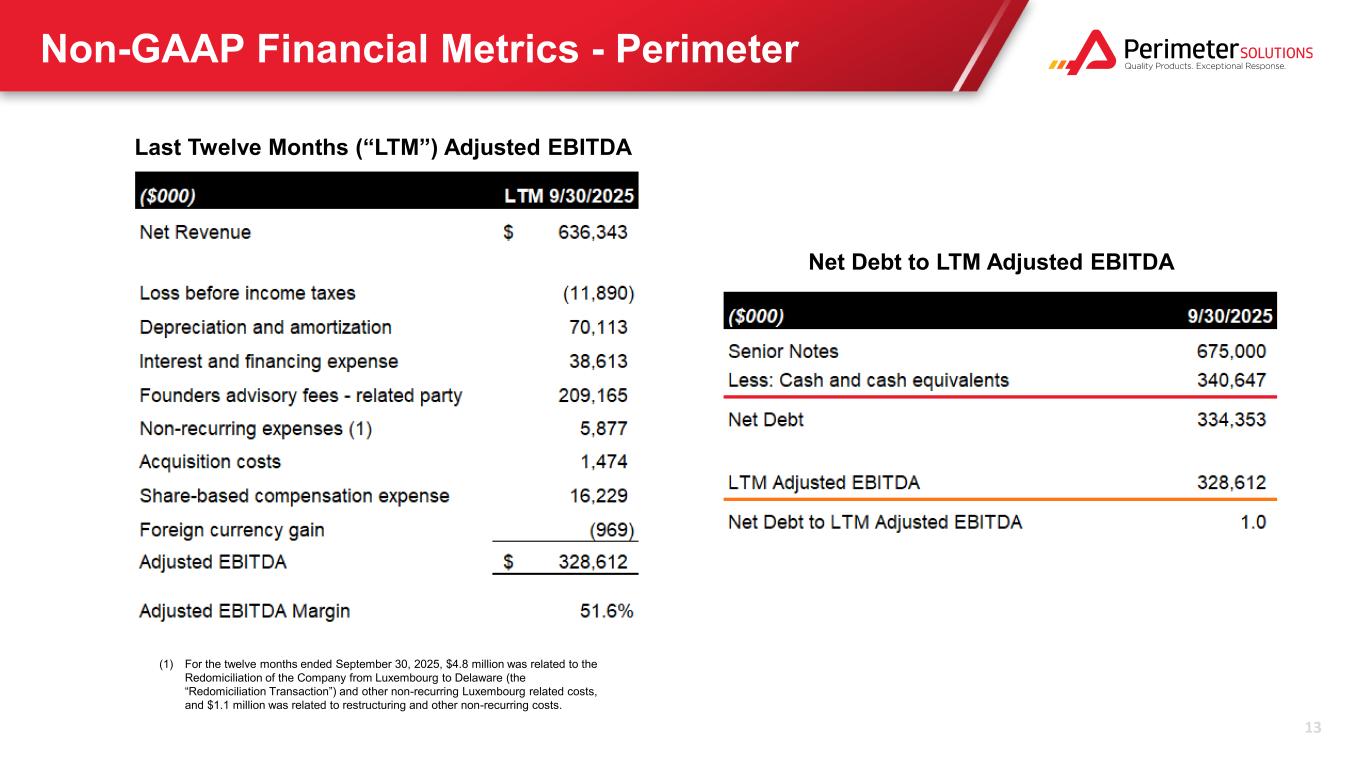

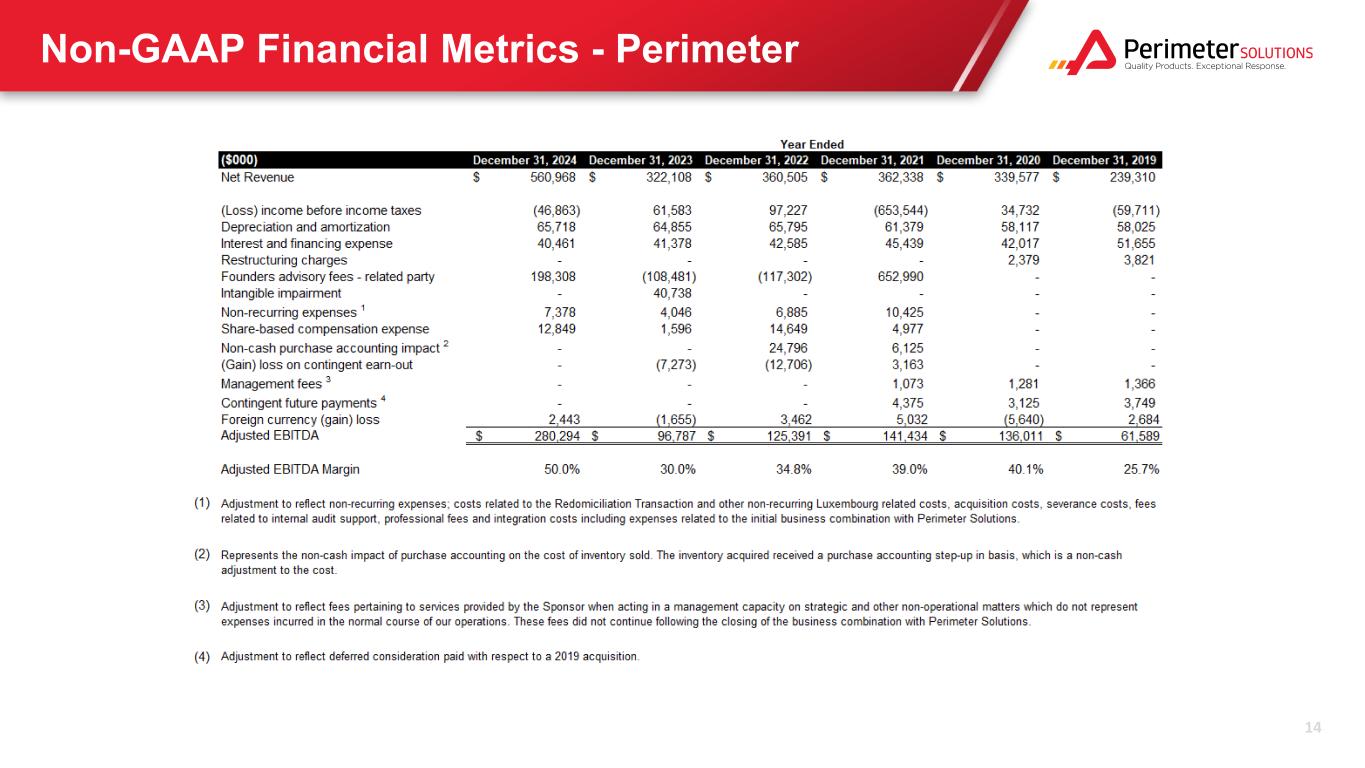

12 Non-GAAP Financial Metrics Adjusted EBITDA & Adjusted EBITDA Margin The computation of Adjusted EBITDA is defined as income (loss) before income taxes plus net interest and other financing expenses, and depreciation and amortization, adjusted on a consistent basis for certain non-recurring, unusual or non-operational items. These items include (i) restructuring, (ii) acquisition related costs, (iii) founder advisory fee expenses, (iv) share-based compensation expense and (v) foreign currency loss (gain). Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net sales. To supplement the Company’s consolidated financial statements presented in accordance with U.S. GAAP, Perimeter is providing a summary to show the computations of Adjusted EBITDA and Adjusted EBITDA Margin, which are non-GAAP measures used by the Company's management and by external users of Perimeter’s financial statements, such as debt and equity investors, commercial banks and others, to assess the Company’s operating performance as compared to that of other companies, without regard to financing methods, capital structure or historical cost basis. Adjusted EBITDA and Adjusted EBITDA Margin should not be considered alternatives to net income (loss), operating income (loss), cash flows provided by (used in) operating activities or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP (in thousands).

13 Non-GAAP Financial Metrics - Perimeter Last Twelve Months (“LTM”) Adjusted EBITDA (1) For the twelve months ended September 30, 2025, $4.8 million was related to the Redomiciliation of the Company from Luxembourg to Delaware (the “Redomiciliation Transaction”) and other non-recurring Luxembourg related costs, and $1.1 million was related to restructuring and other non-recurring costs. Net Debt to LTM Adjusted EBITDA

14 Non-GAAP Financial Metrics - Perimeter